Even years after its inception, the XRP Ledger, one of the leading networks in the crypto space, continues to attract robust adoption and real-world usage. With thousands of transactions being conducted on the leading network’s DEX on a daily basis, it has now reached a historical level that marks its growing role in decentralized trading.

Decentralized Trading On XRP Ledger Accelerates

XRP is experiencing heightened interest not just in buying activity from traders; the XRP Ledger has been seeing significant usage over the past few weeks. While adoption has increased toward the network, the Ledger’s Decentralized Exchange (DEX) activity is breaking past prior highs.

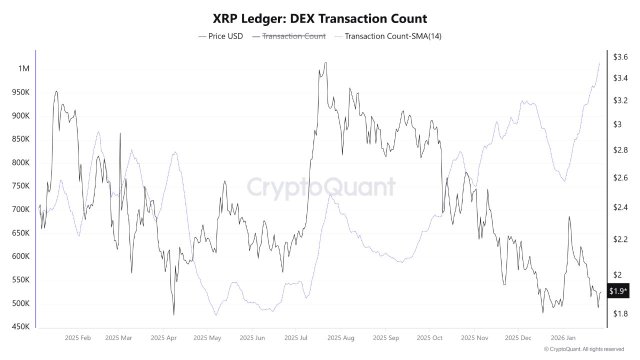

Xaif Crypto, a market expert and investor on the X platform, reported that the Ledger DEX activity has surged to new levels. Specifically, data shows that the activity recently reached a 13-month high, signaling a sharp uptick in on-chain trading across the network.

As more liquidity and transactions move over XRPL’s native DEX infrastructure, the increase is indicative of increasing user involvement. Sustained growth in DEX activity frequently indicates deeper adoption and expanding use cases, in contrast to brief spikes caused solely by speculation.

According to the chart shared by the expert, the number of transactions on the 14-day MA rose to approximately 1.014 million, breaking the ceiling that held throughout all of 2025. With this level of DEX transactions, the XRP Ledger is becoming a more active center for decentralized trade within the larger cryptocurrency ecosystem.

Xaif Crypto stated that this massive transaction count is not just a mere spike; it signals sustained momentum for the Ledger. Currently, the network is witnessing a fresh wave of liquidity and real user engagement. As a result, the expert declares that the Ledger is heating up in 2026.

This milestone comes as the XRP Ledger rolls out a new Lending Protocol (XLS-66), which is attracting institutional-grade credit to the network. With the new Lending Protocol, the Ledger is now evolving into a full financial layer with Rippled 3.1.0.

The protocol includes the ability to create loans on the Ledger, with loan brokers being able to generate fixed-term and fixed-rate, uncollateralized loans. These loans are predictable for professional use.

In addition, these loans are held in a Single Asset Vault, allowing risk-isolated liquidity. Another feature is the off-chain underwriting for uncollateralized options. It boasts native efficiency, which offers low-cost lending without a middleman or intermediaries. In the meantime, Decentralized Finance (DeFi) on the Ledger has just undergone a boost.

The Lending Protocol Gains Institutional Support

Following its historical launch a few days ago, the new XRP Lending Protocol is now experiencing significant support from institutional-level investors. One of the earliest companies to interact with the new protocol is Evernorth, a leading public treasury company.

According to BankXRP, the company is backing the native lending protocol to help transition a $100 billion market cap into a productive, yield-bearing ecosystem. These kinds of moves are an indication that the future of institutional DeFi is becoming native-driven.

Featured image from Shutterstock, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.