In the last week of May, the cryptocurrency market experienced a slowdown in trading activity as participants took profits following recent rallies.

Despite this brief lull, several altcoins have caught the attention of large investors, commonly known as whales, who are accumulating positions in anticipation of potential price gains in June.

Dogecoin (DOGE)

The leading meme coin, DOGE, is among the assets crypto whales are accumulating for potential gains in June. This trend is reflected in the recent surge in DOGE accumulation among whale wallets holding between 1 million and 10 million tokens.

According to Santiment, this group of DOGE whales added 30 million tokens to their wallets over the past week.

Such buying activity by whales often serves as a strong signal to retail traders. Seeing large investors confidently increase their positions can encourage retail participation. This could drive up DOGE’s value as buying momentum builds across the market.

If buying pressure subsists, the token could resume its rally and climb to $0.206.

However, if whale accumulation stalls and selloffs strengthen, DOGE’s value could fall to $0.175.

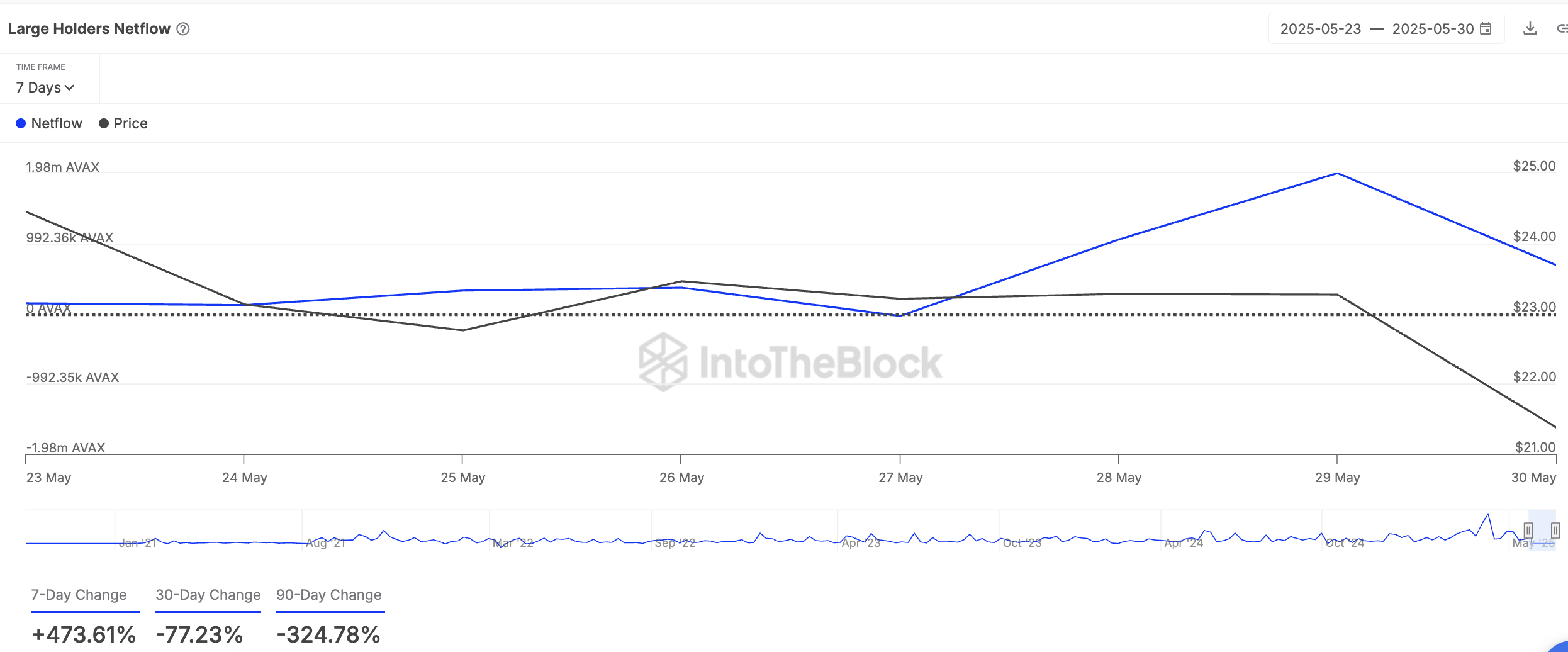

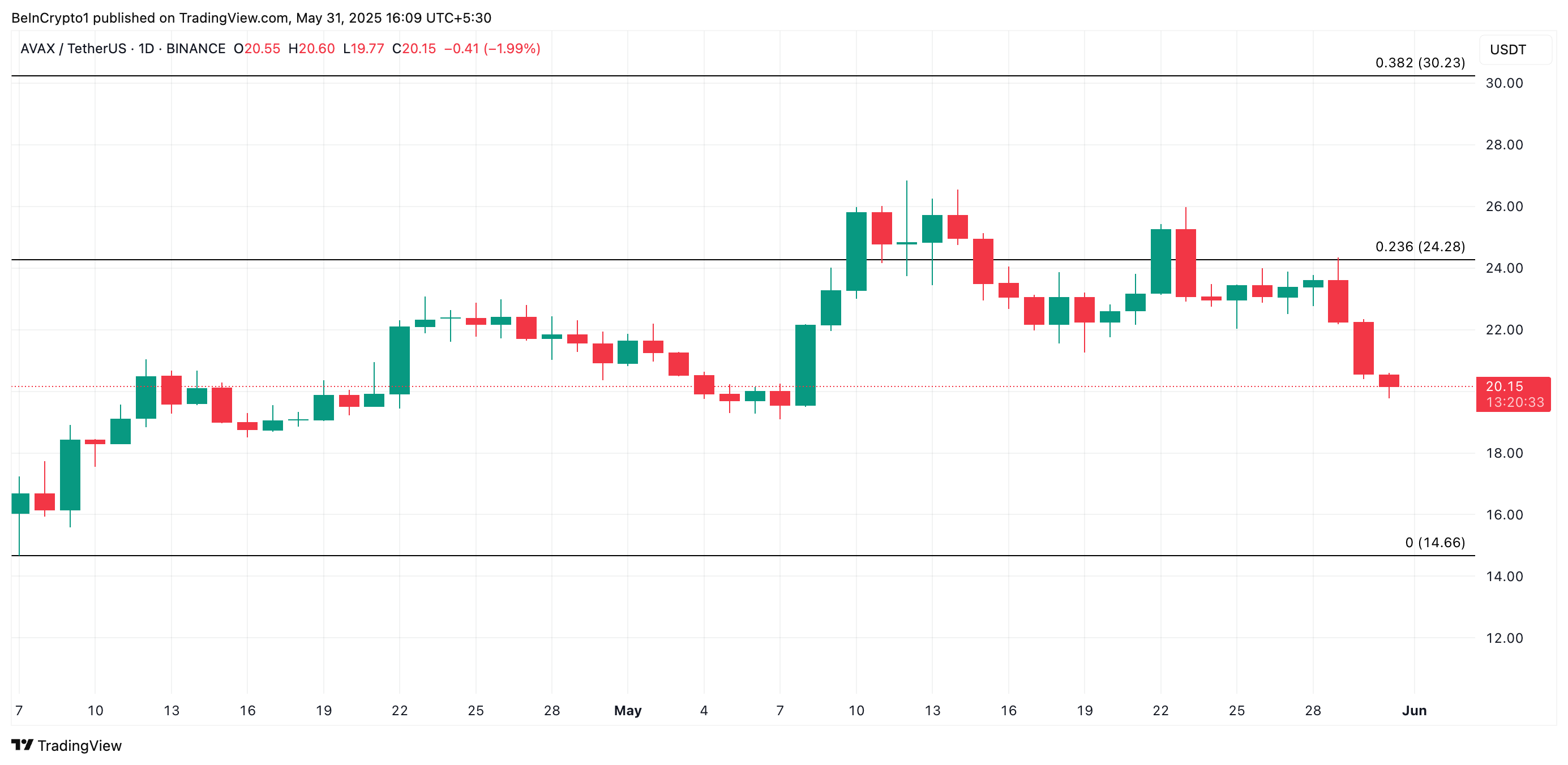

Layer-1 (L1) coin AVAX is another asset crypto whales are holding for gains in June. This is reflected by the 474% uptick in the coin’s large holders’ netflow in the past seven days.

Large holders are whale addresses that hold more than 0.1% of an asset’s circulating supply. Their netflow tracks the difference between the coins they buy and the amount they sell over a specific period.

When an asset’s large holders’ netflow increases, more of its tokens are flowing into the wallets of these major investors than are flowing out. This trend indicates that AVAX whales are accumulating the asset, signaling confidence in its future value.

AVAX could witness a rebound and surge to $24.28 if whale accumulation continues.

On the other hand, the altcoin’s price could extend its decline to $14.66 if the whales begin to sell for profit.

Quant (QNT)

QNT has defied this week’s broader market downturn, posting 7% gains. The token’s near-10% rally appears to be fueled by renewed investor interest following the launch of Overledger Fusion, a Layer 2.5 network designed to bridge institutions, enterprises, and decentralized finance (DeFi) ecosystems.

It has also driven a surge in whale accumulation, indicated by the 1083% rally in the token’s large holders’ netflow over the past week. This uptick signals growing confidence in QNT’s short-term performance and hints at the likelihood of further rallies as large investors increase their exposure.

If these traders continue to buy QNT, they could drive its price to $115.20.

However, if selloffs resume, QNT could slip below $101.87 and fall toward $93.52.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.