Spot Bitcoin ETFs are drawing institutional cash at a record pace.

According to Bitwise CIO Matt Hougan, the products are heading for their strongest quarter yet as wirehouse approvals and inflation-hedge demand unlock new capital pools.

Sponsored

Sponsored

Distribution Unlocks Momentum For ETFs

By the end of Q3, Bitcoin ETFs had attracted $22.5 billion and are on track to reach $30 billion by year-end.

US spot Bitcoin fund trading rose to $7.5 billion in a single day this month—proof of liquidity deep enough for large institutional orders with minimal slippage.

As Bitcoin broke above $100,000 and hit $125,000, ETF activity climbed in lockstep. Bloomberg’s Eric Balchunas said $IBIT led weekly ETF flows with $3.5 billion—around 10% of all US inflows.

All 11 spot ETFs, including $GBTC, ended the week in the green, which he called “two steps forward mode.”

Hougan outlined three key drivers behind the surge:

Sponsored

Sponsored

Wirehouse distribution: Major brokerages such as Morgan Stanley and Wells Fargo now offer crypto ETFs directly to clients, giving thousands of advisors regulated Bitcoin access.

The “debasement trade”: Investors are shifting to scarce assets like gold and Bitcoin to hedge against currency dilution and fiscal expansion.

Reflexive momentum: Rising prices attract media coverage, which fuels more ETF buying and reinforces the rally.

Hougan pointed to Morgan Stanley’s new guidance allowing advisors to allocate up to 4% of portfolios to crypto. This policy could channel trillions into regulated products.

Wells Fargo and Merrill Lynch have followed, expanding institutional pipelines. He added that strong Bitcoin quarters often coincide with multi-billion inflows, reinforcing the link between price and capital.

BlackRock’s IBIT takes the lead in Bitcoin ETF dominance

BeInCrypto reported that IBIT is now BlackRock’s most profitable ETF, generating $244.5 million annually from a 0.25% fee with nearly $100 billion in AUM. It has overtaken the S&P 500 ETF (IVV) despite its larger scale.

Sponsored

Sponsored

Bloomberg data show IBIT approaching $100 billion in under 450 days—compared to over 2,000 for Vanguard’s VOO—making it the fastest-growing ETF ever.

This dominance narrows, spreads, and boosts liquidity, allowing institutional flows to recycle efficiently. US funds now hold about 90% of global Bitcoin ETF assets, underscoring Wall Street’s tightening grip on digital-asset liquidity.

Market structure shifts beyond cycles

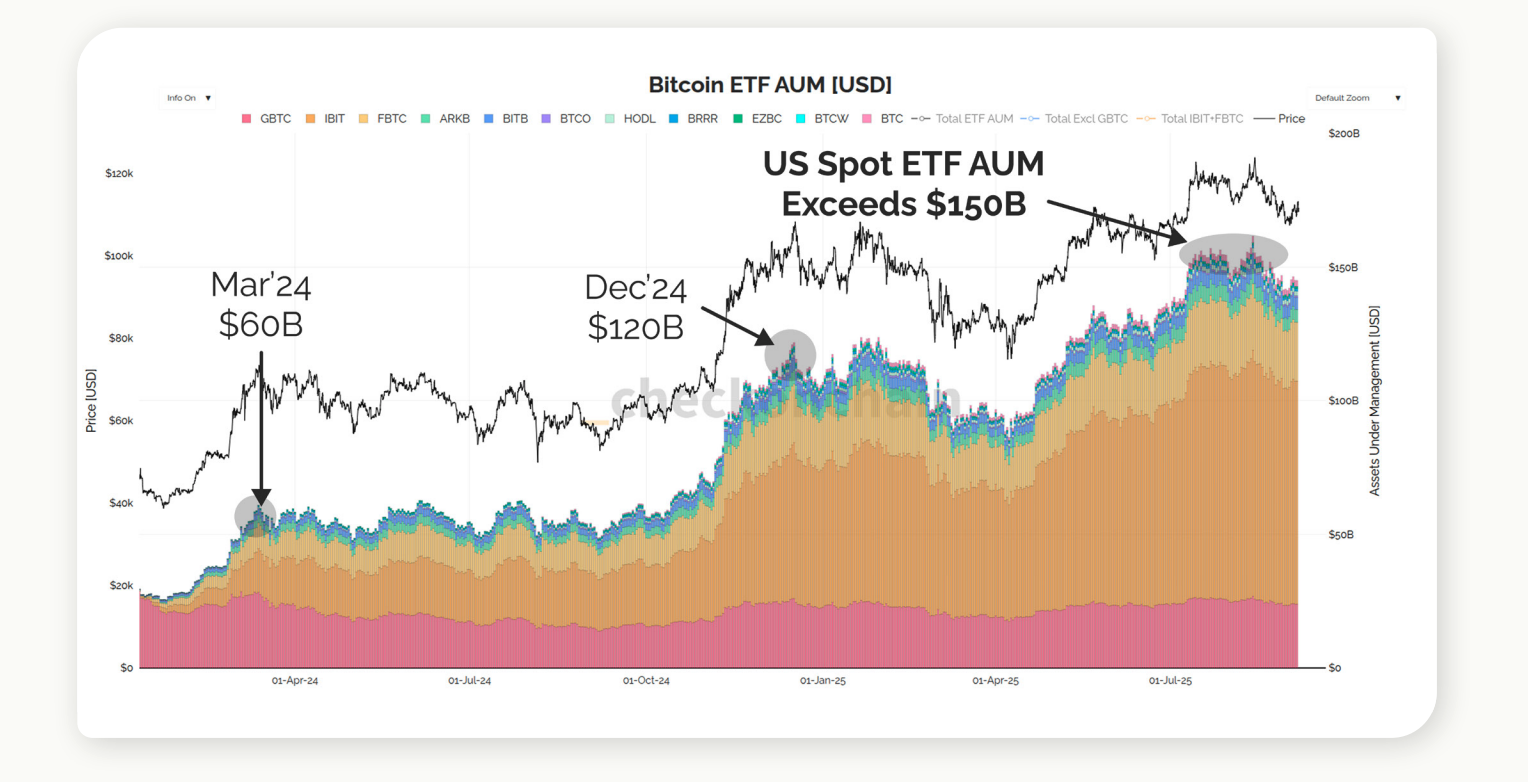

Analysts say this inflow wave is reshaping Bitcoin’s market structure. Checkonchain Analytics co-founder James told BeInCrypto that ETF inflows—roughly $60 billion so far—represent “tens of billions in fresh institutional capital,” not just on-chain holders moving into funds.

He added that long-term investors are realizing $30–100 billion in monthly profits, slowing price acceleration despite rising demand.

Sponsored

Sponsored

“Some holders are migrating from on-chain to ETFs—that’s happening. But they’re not the majority. The demand has been enormous—tens of billions in institutional capital—yet sell-side pressure remains. Since October 2024, IBIT has surged ahead of peers and remains the only fund with sustained inflows. The US now accounts for roughly 90% of global ETF holdings.”

K33 Research argues that institutional adoption and macro policy alignment have ended Bitcoin’s four-year halving rhythm. It has been replaced by a liquidity-driven regime.

James echoed this view, saying, “Bitcoin now responds to the world rather than the world responding to Bitcoin.”

ETF inflows, sovereign allocations, and derivatives growth have become the new anchors of price discovery. K33 data show open interest and momentum remain high but not extreme—suggesting brief corrections rather than a structural reversal.

Still, skeptics warn that rising leverage could trigger short pullbacks. The key question is whether billion-dollar trading days reflect fresh inflows or rotations from legacy funds like GBTC.

For now, record volumes, wider distribution, and deep liquidity all support Hougan’s thesis: expanded wirehouse access is Bitcoin’s strongest tailwind heading into year-end.