Solana has remained under sustained pressure after a prolonged decline that began well before recent market weakness intensified. The price drop gradually eroded confidence, prompting influential investors to adjust their positioning.

Historical patterns now point to elevated downside risk. While oversold signals are emerging, broader data still reflect a cautious outlook for SOL.

Sponsored

Sponsored

Solana Holders Begin Pulling Back

Solana’s HODLer Net Position Change has started to trend lower. Receding green bars indicate that long-term holders are slowing accumulation. This cohort typically plays a stabilizing role during corrections. A reduction in buying activity suggests weakening conviction rather than aggressive distribution at current price levels.

Although the data does not confirm active selling, it highlights fading demand from influential investors. Reduced accumulation often limits recovery attempts during oversold phases. Without renewed buying pressure, SOL may struggle to sustain rebounds, especially if broader market conditions remain fragile.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

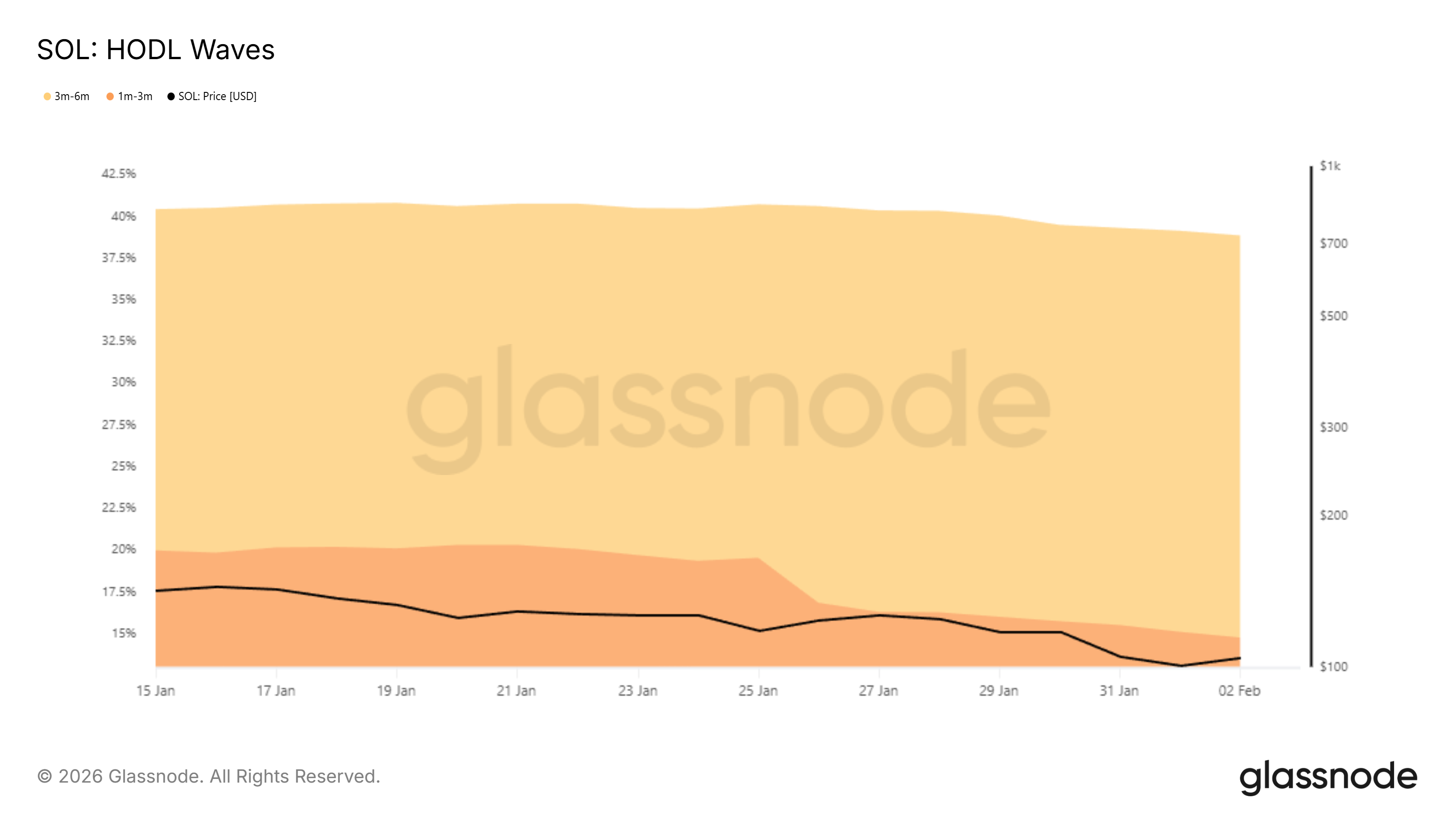

HODL Waves provide additional insight into investor behavior. Wallets that accumulated SOL one to three months ago declined by 5%. Meanwhile, the share of holders aged three to six months increased by 4.5%. This shift shows that underwater investors continue holding despite unrealized losses.

While resilience remains, patience may not be unlimited. Historically, prolonged drawdowns test a holder’s conviction. If Solana’s price weakens further, these cohorts may begin distributing. Such behavior would add downside pressure and reinforce the prevailing bearish macro trend.

Sponsored

Sponsored

SOL Price Could See Further Decline

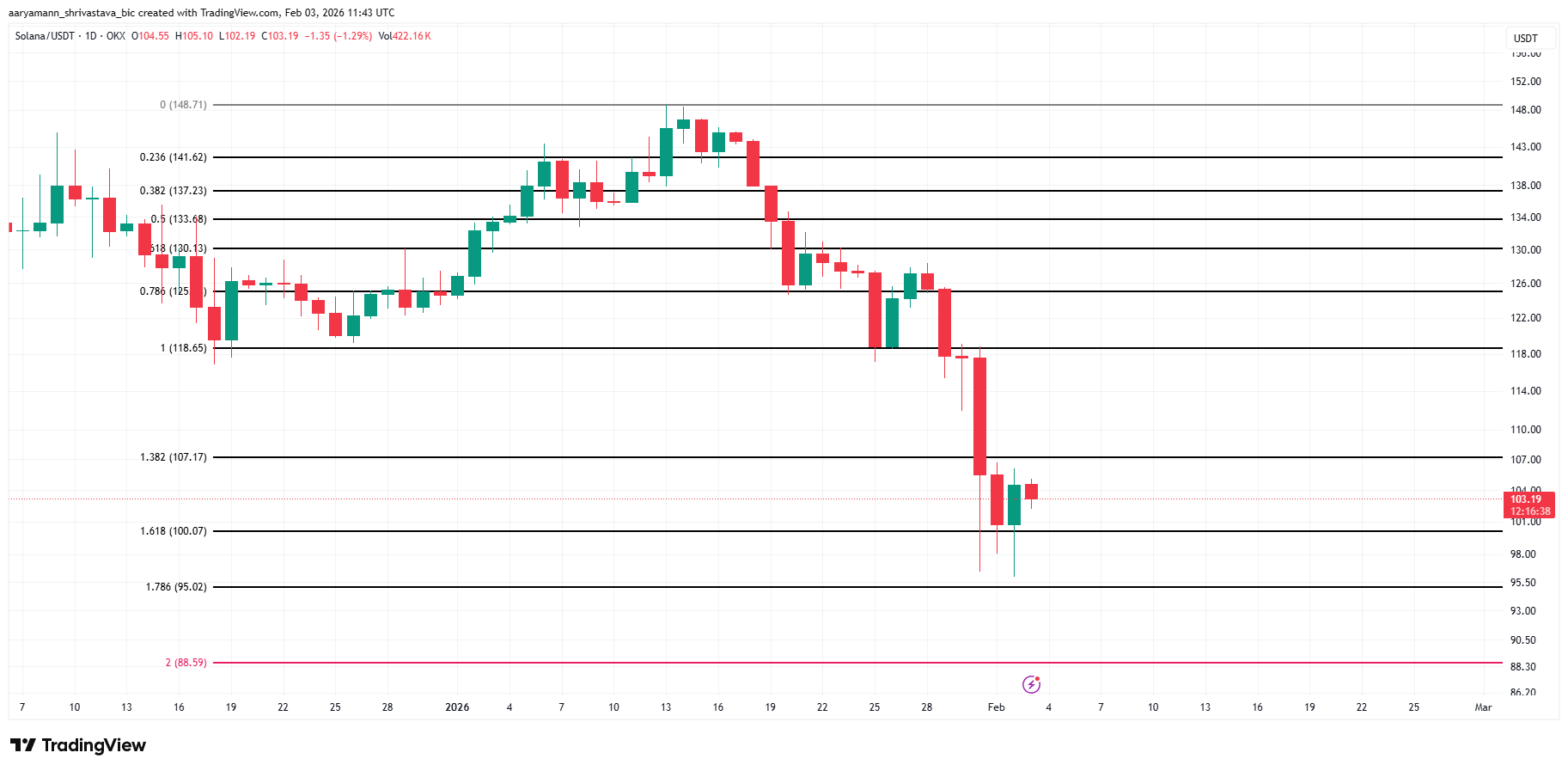

Solana is trading near $103, holding above the critical $100 support. This level aligns with the 161.8% Fibonacci Extension. Maintaining this zone is important for short-term stability. However, the failed rally places downside risk toward $95, corresponding with the 178.6% Fibonacci level.

Momentum indicators reflect oversold conditions. The Money Flow Index is nearing the oversold threshold. Historically, each dip below this level triggered short-lived rebounds. These bounces often failed to reverse the broader trend, leading to renewed declines after brief recoveries.

In the near term, Solana may either defend $100 or rebound toward $107 resistance. A technical bounce remains possible due to oversold conditions. However, macro signals continue to favor downside risk. Without stronger demand, SOL appears vulnerable to another breakdown below $100.

The bearish outlook would be invalidated if Solana flips $107 into support. A sustained move higher could open the path toward $118. Securing that level requires consistent inflows and renewed investor confidence. Without capital returning to SOL, upside attempts are likely to remain limited.