XRP price was at the cusp of a breakout after a multi-day climb, but the potential rally was cut short with FUD (Fear, Uncertainty, and Doubt), following a massive unlock.

Ripple executives attempted to assuage the situation, but clarifications have been insufficient to salvage the XRP price amid weekend volatility.

Ripple Unlocks 1 Billion XRP: All You Need To Know

Fear, uncertainty, and doubt spread across the XRP community on Saturday, following Ripple’s move to release 1 billion tokens from escrow.

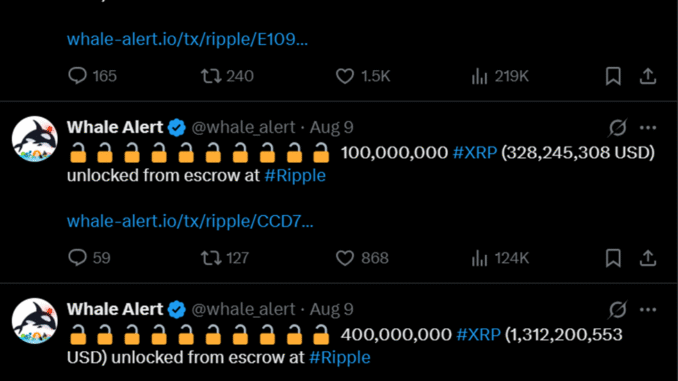

According to Whale Alert, Ripple escrow unlocked 500 million, 100 million, and 400 million XRP tokens, three transactions worth $3.28 billion.

These tokens were previously held on Escrow as part of a 2017 protocol intended to stabilize market supply. The transactions turned heads, amid speculation that it would precede a sell-off.

“They want you to buy XRP while they sell it,” wrote CFA Rajat Soni, a popular user on X.

Soni’s comment, among others, alluded to Ripple manipulating its escrow release schedule. Meanwhile, XRP price had been on a bullish streak, drawing tailwinds from the positive break in its longstanding case between Ripple and the US SEC (Securities and Exchange Commission).

Against this backdrop, Ripple CTO David Schwartz moved to clarify the FUD, ascribing the escrow release to a routing activity.

“They always release on the first day of the month. You may not necessarily see any on ledger activity just because the escrow has released, though. The ledger doesn’t do anything by itself; it always waits for someone to submit a transaction to trigger it,” Schwartz articulated.

Community members indicated that Ripple escrow accounts have randomly released several contracts in the last two months.

Notwithstanding, Ripple’s escrow system is a longstanding subject for debate, with the firm holding a significant amount of XRP in the contractual arrangement. Data on XRPscan shows approximately 35.6 billion XRP still held in escrow after the August 9 release.

“…can Ripple manipulate the escrowed contract release date at any given point? So in theory, they could release the whole 36 billion XRP in the next 5 minutes?” one user posed.

Based on its working mechanics, Ripple’s escrow contract releases up to 1 billion XRP monthly, a system designed to avoid flooding the market.

It helps maintain the XRP price, and while the system is structured and predictable, individual transactions, particularly those displayed on the XRP Ledger, tend to move markets.

Ripple Price Outlook: How Are XRP Bulls and Bears Positioning?

Analysts say that the XRP price may be poised for a breakout on the higher timeframe. However, Ripple price appears to be cooling off on the one-day timeframe before the next move, with bulls already taking positioning.

Based on the bullish volume profiles (blue), bulls are waiting to interact with the Ripple price just above the demand zone between $2.9611 and $2.7354. This means the downtrend could continue another 5% to 7% before a possible turnaround.

The RSI (Relative Strength Index) indicator is also dropping, a sign of falling momentum. If the immediate support at $3.1061 fails to hold, the XRP price could drop until bulls have their say at the aforementioned level, with the demand zone offering significant support downward.

Conversely, increased buying pressure above current levels could cause the XRP price to resume its uptrend, potentially overpowering the bears (red volume profiles).

However, with the supply zone between $3.4000 and $3.5493 causing overhead pressure, bulls looking to take long positions on XRP should probably wait for a candlestick close above the mean threshold or midline of the supply zone at $3.4687.

A candlestick close above this level on the one-day timeframe could catalyze further upside, setting the stage for the Ripple price to reclaim its peak of $3.6607. Such a move would constitute a 7% climb above current levels.

The post Ripple’s $3.28 Billion Escrow Unlock Derails XRP Price Breakout appeared first on BeInCrypto.