Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and settle in to catch up on Ripple’s big move. This major crypto player is making headlines with a Wall Street alliance that could reshape the future of digital finance.

Crypto News of the Day: Ripple Picks Wall Street Giant to Safeguard RLUSD Reserves

Ripple has selected the Bank of New York Mellon Corporation (BNY Mellon) as the primary custodian for RLUSD reserves. The move is designed to scale enterprise-grade digital finance.

BNY, with over $43 trillion in assets under custody, will also provide Ripple with transaction banking services to support RLUSD’s operations.

While the news broke on July 9, the deal happened on July 1, reflecting Ripple’s ambition to bridge traditional finance (TradFi)and blockchain innovation.

RLUSD is Ripple’s dollar-backed stablecoin, which was approved in December. It is issued under the New York Department of Financial Services (NYDFS) Trust Charter, positioned as an institutional-grade asset built for utility, not speculation.

Ripple described the partnership as a “shared commitment to building the infrastructure for the future of finance.”

The collaboration comes as Ripple intensifies its regulatory footprint in the US, including its recent application for a national banking license overseen by the Office of the Comptroller of the Currency (OCC).

“BNY brings together demonstrable custody expertise and a strong commitment to financial innovation in this rapidly changing landscape. Their forward-thinking approach makes them the ideal partner for Ripple and RLUSD,” read an excerpt in the announcement, which cited Jack McDonald, Ripple’s SVP of Stablecoins.

RLUSD is backed 1:1 by high-quality liquid assets, including cash, equivalents, and US treasuries. In a recent US Crypto News publication, Bitcoin maxi Max Keiser highlighted the use of US treasuries among stablecoin issuers.

Meanwhile, RLUSD’s design features strict reserve management, independent audits, clear redemption rights, and full asset segregation, which meet the expectations of institutional users and regulators alike.

Besides BNY Melon, Swiss financial institution AMINA Bank also offers Ripple’s RLUSD custody and trading.

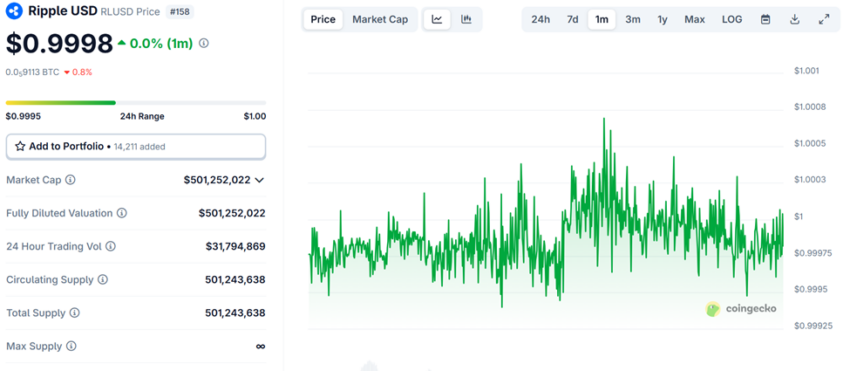

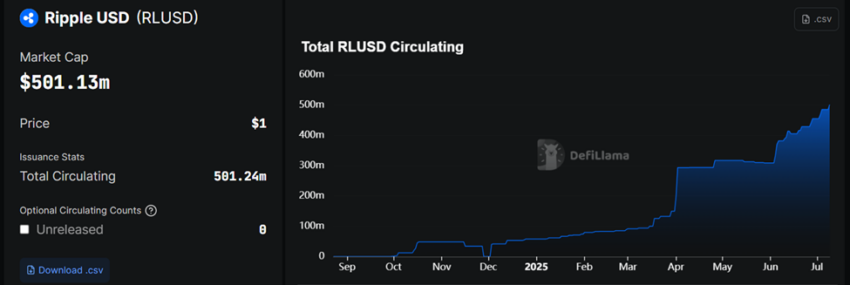

Ripple’s RLUSD Surpasses $500 Million in Circulating Supply

Meanwhile, Ripple’s decision to secure Wall Street-grade infrastructure comes on the heels of a major milestone. The RLUSD stablecoin’s circulating supply has surged past $500 million just seven months after launch.

Issued on both the XRP Ledger and Ethereum, RLUSD debuted in December 2024. It has quickly become one of the top 20 dollar-pegged stablecoins.

Standing at position 16 on DefiLlama as of this writing, BeInCrypto recently reported Ripple’s RLUSD as the fastest-growing stablecoin in June after a 47% surge that month.

According to CoinGecko data, the asset sees around $26 million daily trading volumes, bolstered by growing institutional and cross-border payment demand. As of this writing, trading volume sits shy of $32 million.

The surge in adoption aligns with a broader trend, with the stablecoin market swelling to over $255 billion. US dollar-linked tokens account for more than 95% of that figure.

RLUSD’s growth reflects rising confidence in regulated, enterprise-focused stablecoins at a time when major institutions are exploring tokenized finance.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

Scammers use OP_RETURN to lay claim to Mt. Gox’s lost 80,000 Bitcoin.

Why the Trump–Musk feud could be bullish for Bitcoin.

Ripple CEO heads to Capitol Hill as Senate debates the future of crypto.

Fidelity fuels Ethereum buzz, but Bitcoin sell risk stalls ETH rally.

Bitcoin gears up for a supply squeeze as miners and HODLers clamp down.

Public firms see stock prices skyrocket as Ethereum investment strategies pay off.

Is Elon Musk right to criticize the rising debt ceiling and bet on Bitcoin?

Solana beats Ethereum and Tron with $271 million in Q2 network revenue.

Report reveals that mainstream financial publications largely ignored Bitcoin in Q2.

Crypto Equities Pre-Market Overview

The post Ripple Picks $43 Trillion Titan For Its Stablecoin Reserves | US Crypto News appeared first on BeInCrypto.

Your digital dollars are protected… pic.twitter.com/gbdgDaxugK

Your digital dollars are protected… pic.twitter.com/gbdgDaxugK @Ripple's RLUSD stablecoin is growing on @ethereum, with supply up ~4x since January. pic.twitter.com/nQ88TYVtnc

@Ripple's RLUSD stablecoin is growing on @ethereum, with supply up ~4x since January. pic.twitter.com/nQ88TYVtnc (@tokenterminal) June 28, 2025

(@tokenterminal) June 28, 2025