Quick Facts:

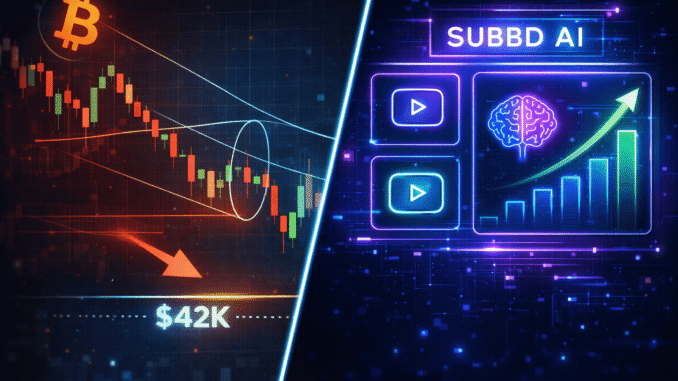

➡️ Peter Brandt’s warning of a Bitcoin drop to $42,000 suggests a potential major correction driven by “campaign selling” and buyer exhaustion.

➡️ A 50% drawdown in $BTC would likely trigger a capital rotation into utility-driven sectors less correlated with macro finance.

➡️ SUBBD Token uses AI tools to disrupt the $85B creator economy, offering a revenue-based alternative to speculative assets.

➡️ With over $1.4M raised and a 20% APY staking option, the project is attracting investors seeking yield and utility during market uncertainty.

Veteran trader Peter Brandt isn’t known for mincing words. His latest analysis?

It sent a distinct chill through a market that was just starting to feel invincible. By suggesting Bitcoin ($BTC) is merely a ‘hop, skip, and jump’ away from the $42,000 level, Brandt isn’t just calling for a correction.

He’s outlining a brutal 50% drawdown from the highs. Brandt’s proprietary ‘factor’ trading methodology, for those not glued to the charts, relies on classical principles where multi-month patterns signal buyer exhaustion.

That prediction matters for market structure. A retreat to $42,000 would wipe out months of institutional accumulation, resetting the board to mid-2024 levels.

Brandt specifically flags ‘campaign selling’, large entities distributing holdings into rallies, as a precursor to these capitulation events.

Sure, ETF inflows have provided a floor, but technical structures don’t care about BlackRock’s balance sheet. If supports at $85,000 and $72,000 buckle, the air pocket down to the low $40k region looks ominously empty.

Smart money rarely sits in cash during a downturn. It rotates. When the ‘store of value’ asset gets shaky, capital historically flows toward utility-driven projects with uncorrelated growth narratives. This flight to quality tends to favor sectors with tangible revenue models, specifically the Web3 creator economy.

As Bitcoin faces a potential stress test, investors are scrutinizing SUBBD Token ($SUBBD). The project is merging AI utility with the $85B content creation industry, positioning itself as a hedge against macro volatility.

AI-Powered Revenue Models Offer Stability Amidst Volatility

While Bitcoin remains tethered to Fed policy and liquidity cycles, the creator economy runs on a different fuel: user engagement. The sector is valued at nearly $85B, yet it’s plagued by rent-seeking intermediaries extracting up to 70% of earnings.

SUBBD Token ($SUBBD) steps in not merely as a speculative asset, but as the transactional backbone designed to dismantle those fees.The core idea? Using AI to reclaim profitability.

By integrating features like an AI Personal Assistant for automated interactions and AI Voice Cloning, the platform slashes the admin overhead that burns out influencers. Plus, tokenization allows for immediate, transparent payments, solving the ‘net-60’ terms that plague traditional Web2 platforms (a nightmare for creators).

For investors, this represents a pivot from ‘number go up’ speculation to ‘revenue share’ mechanics. If the platform captures even a fraction of market share from legacy giants, demand for $SUBBD, needed for governance and settlement, could decouple from broader crypto trends.

EVM-compatible smart contracts ensure this isn’t a walled garden; it’s a composable part of the wider Ethereum ecosystem.

By allowing creators to mint token-gated content, SUBBD Token effectively turns every creator’s fanbase into a decentralized liquidity pool. That stabilizes the economy with real-world transaction volume rather than just trading speculation.

Get your $SUBBD here.

Presale Data Signals Appetite for High-Yield Utility

The market’s appetite for this utility-first approach is quantifiable. According to the official presale data, SUBBD Token ($SUBBD) has already raised $1.4M, a figure suggesting smart money is positioning itself before the public listing.

With tokens currently priced at $0.05749, early entrants are buying into a valuation based on platform growth rather than hype cycles.Then there’s the staking architecture, a critical defense against the volatility Brandt predicts.

Stakers can lock tokens to earn a fixed 20% APY during the first year. This incentive structure does two things: it removes circulating supply (reducing sell pressure) and rewards believers willing to wait for the platform’s full deployment.

It aligns with a broader shift in allocation strategies. As traders brace for “campaign selling” in major caps, rotating into presales with double-digit APYs offers a defensive maneuver.

The SUBBD Token model, combining yield with access to exclusive ‘HoneyHive’ content, creates a sticky ecosystem where the token has actual velocity, not just speculative noise.

Explore the $SUBBD presale now.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments, including presales, carry inherent risks, and market predictions by analysts like Peter Brandt are subject to change based on real-time data.

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.