The LINK price is trading near $8.60, under pressure despite a fresh catalyst from the Chainlink Reserve, which added over 125,000 LINK in a single update. While broader crypto markets weaken, on-chain accumulation and ETF flows suggest a widening disconnect between price action and underlying demand.

Chainlink Reserve Growth Signals Long-Term Commitment

The Chainlink Reserve continues to expand its footprint as a long-term sustainability mechanism for the network. According to official data, the reserve has accumulated 125,454.48 LINK, bringing total holdings to approximately 1.9 million LINK. This reserve is funded through a combination of off-chain enterprise revenue and on-chain service usage, reinforcing its role as infrastructure rather than a market-facing liquidity tool.

Meanwhile, this steady accumulation occurs independently of short-term LINK price USD fluctuations. That separation is notable. Historically, reserves of this nature tend to grow during periods of suppressed market confidence, when usage-driven revenues quietly outpace speculative demand.

At the same time, the reserve’s design reduces reliance on inflationary incentives, aligning with Chainlink’s broader goal of long-term network sustainability rather than cyclical price appreciation.

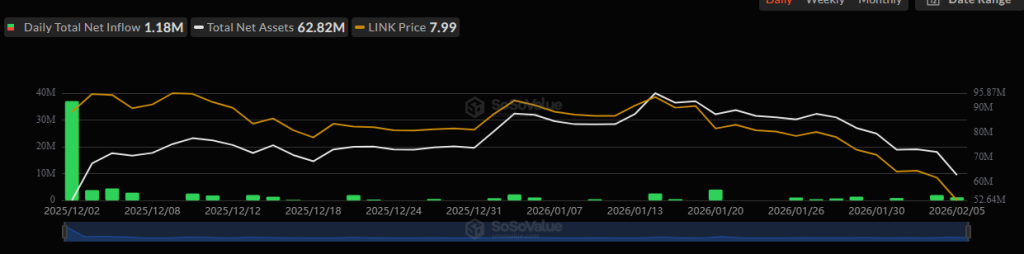

ETF Inflows Contrast Broader Crypto Outflows

From a flows perspective, Chainlink stands out. While Bitcoin and Ethereum ETFs have experienced consistent outflows during recent market stress, LINK ETF products have yet to record a single day of net outflows. Data shows cumulative inflows of $78.63 million, representing roughly 1.11% of LINK’s market capitalization.

Notably, institutional vehicles such as Grayscale and Bitwise have maintained their exposure even as volatility increased. That persistence suggests portfolio-level conviction rather than momentum-driven positioning. Still, ETF stability alone has not insulated the LINK price chart from downside pressure.

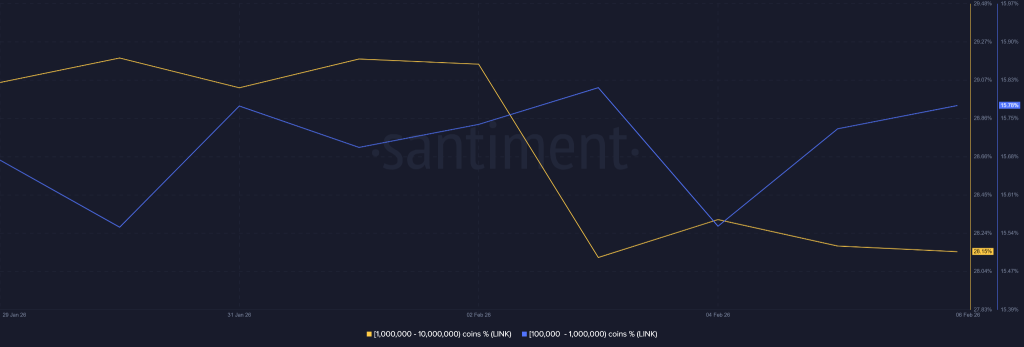

Whale Distribution Adds Near-Term Pressure

That said, on-chain supply distribution reveals a more complex picture. Addresses holding between 1 million and 10 million LINK have been net sellers over the past 48 hours. This cohort historically acts as a liquidity driver during periods of market stress, and their activity aligns with recent downside moves.

Conversely, wallets holding 100,000 to 1 million LINK continue to accumulate. This divergence suggests a transfer of supply from larger entities to mid-sized holders rather than broad capitulation. Still, until selling from the upper bracket cools, downward pressure on LINK crypto markets may persist.

Technical Zones and Risk Framing

From a technical perspective, analysts continue to closely monitor lower channel supports. If demand weakens further, $5 appears as a historically relevant zone where price compression previously stabilized. A deeper downside scenario places attention on the $1.20 region, which aligns with long-term cycle extremes rather than base expectations.

Still, the LINK price analysis suggests that these levels on chart function more as stress-test markers than forecasts. With the LINK price already down materially from cycle highs, further declines would likely require sustained macro deterioration and continued whale distribution.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.