TL;DR

Dogecoin has surged by double digits in the past 14 days, prompting bullish predictions from analysts who see potential for further gains.

Whale accumulation and the possible launch of a spot DOGE ETF approval in the US are two key bullish factors that could support long-term upside, though the impact of recent purchases remains insignificant.

What Does the Future Hold?

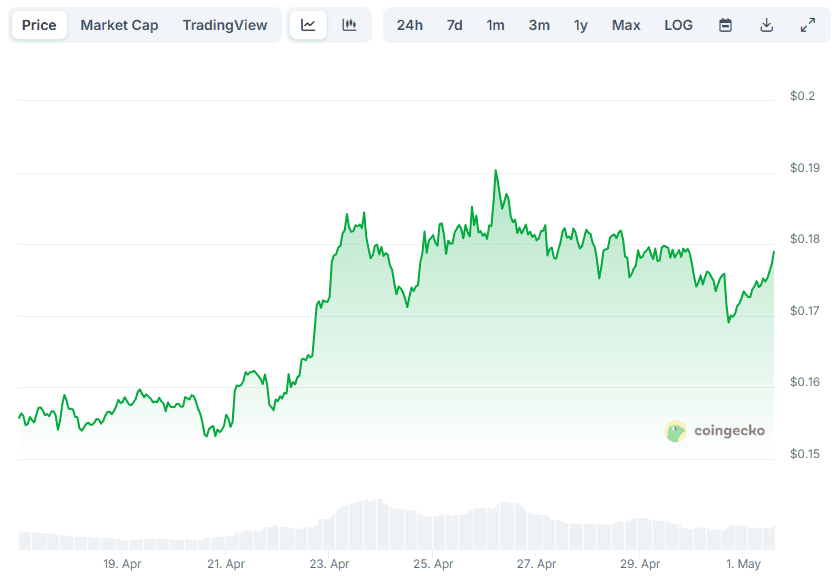

The largest meme coin in terms of market capitalization saw its price rally by almost 15% in the past two weeks. It pumped to as high as $0.19 on April 26 before retracing to the current $0.18 (per CoinGecko’s data).

Numerous market observers have noted the positive performance lately, predicting a surge that has yet to stun the community. The X user Trader Tardigrade claimed DOGE has completed a price breakout when crossing $0.175, envisioning a rise above $0.20 in the following days.

CryptoBullet was also optimistic. The analyst believes the OG meme coin “prints a textbook accumulation cylinder,” and according to this pattern, we might witness a “giant pump” in the next few months. They forecasted a possible cycle top of over $3.20 by the end of the year and then a subsequent drop to the current levels by 2027.

Crypto Patel seems to be among the biggest bulls. The technical analyst argued that DOGE has bounced from the long-term support zone of $0.169 and could now be poised for a massive rally to as high as $32.

Of course, such a price explosion seems highly unrealistic at this stage, as it would require Dogecoin’s market capitalization to exceed $4 trillion. For comparison, the entire crypto sector is currently valued at just above $3 trillion.

The Bullish Factors

One element that could positively impact the valuation of the meme coin is the whales’ activity. X user Ali Martinez revealed that large investors (those holding between one million and ten million DOGE) have accumulated 100 million tokens over the past week.

The whales now own more than 10.5 billion DOGE, representing roughly 7% of the circulating supply of the asset.

Such accumulations are usually monitored by smaller players and could encourage them to hop on the bandwagon, too. Purchasing DOGE tokens also reduces the asset’s supply on the open market, which, combined with non-declining demand, could trigger price spikes. However, in this particular case the scooped up amount (worth less than $20 million) seems insignificant to propel that type of scenario.

Another factor worth exploring is the possible approval of a spot DOGE ETF in the United States. The investment vehicle would provide investors with an easy and regulated way to gain exposure to the meme coin.

Much like buying traditional stocks, the spot ETF would be available through authorized brokerage accounts. Investors would hold shares of the fund, while the fund itself would purchase and securely store the actual cryptocurrency to support those holdings.

The companies racing to launch such a product in the USA include 21Shares, Bitwise, and others. Earlier this month, 21Shares filed with the SEC for approval, naming Coinbase Custody as the custodian of the fund. Just a few days ago, Nasdaq submitted a form with the regulator, proposing the listing and trading of shares of the 21Shares Dogecoin ETF on its exchange.

Following that development, the approval chances before the end of 2025 climbed to 75% (according to Polymarket).

The post Interesting Dogecoin (DOGE) Price Predictions: New ATH on the Way? appeared first on CryptoPotato.