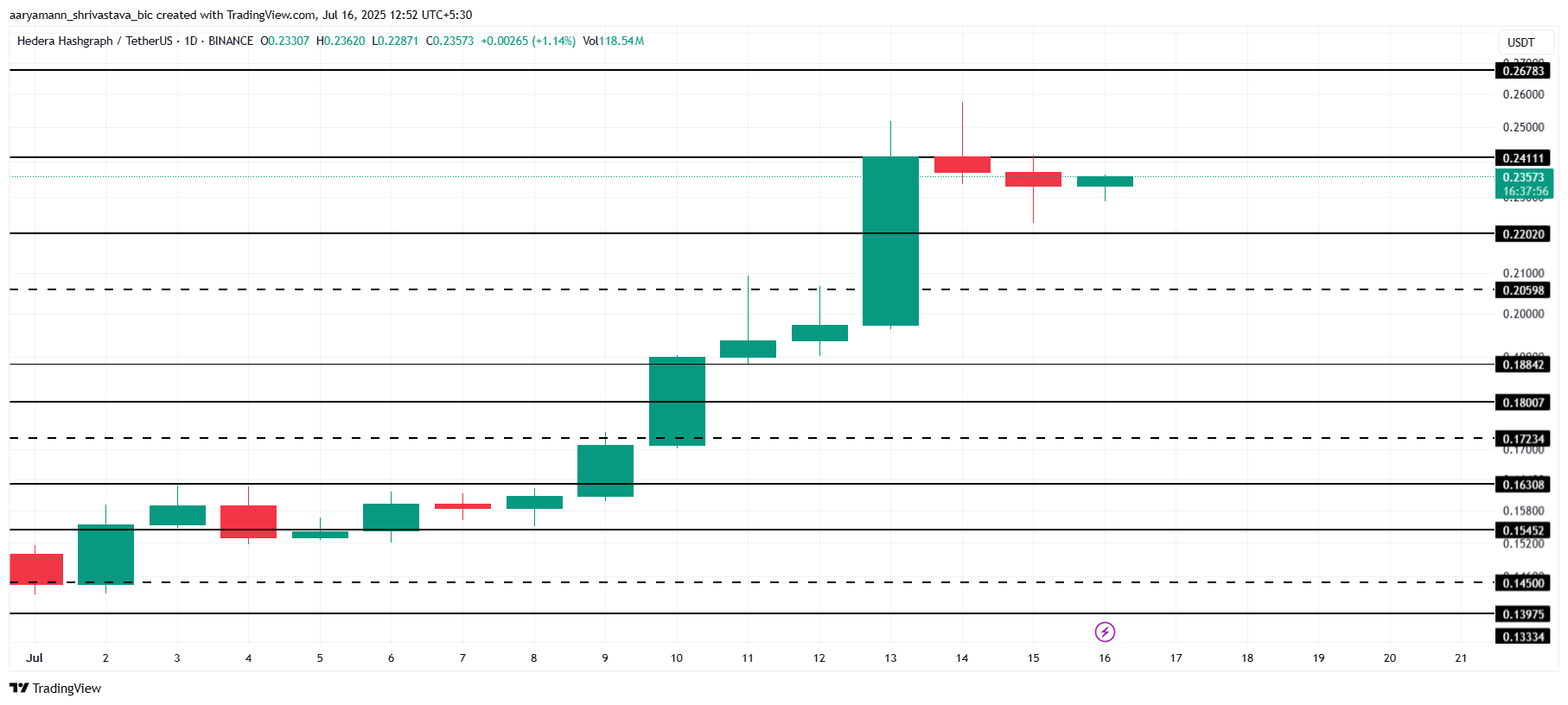

HBAR has experienced a surge in price recently, reaching new highs. However, the altcoin faced a crucial resistance level at $0.241, which it has struggled to breach.

As a result, traders are now facing mounting pressure, and worsening conditions may trigger significant liquidations.

HBAR Traders Are In Trouble

The Relative Strength Index (RSI) shows that HBAR is currently overbought. The indicator is extending above the 70.0 threshold, which historically signals a potential reversal. As the market experiences saturation, bullish momentum could shift to bearish. Investors tend to take profits in such situations, which may drive the price lower.

With the market cooling down, there is a growing concern about a price correction. Investors are now on high alert, and selling could intensify if the overbought conditions persist. As a result, many traders could be looking to liquidate their positions before further downside risks materialize.

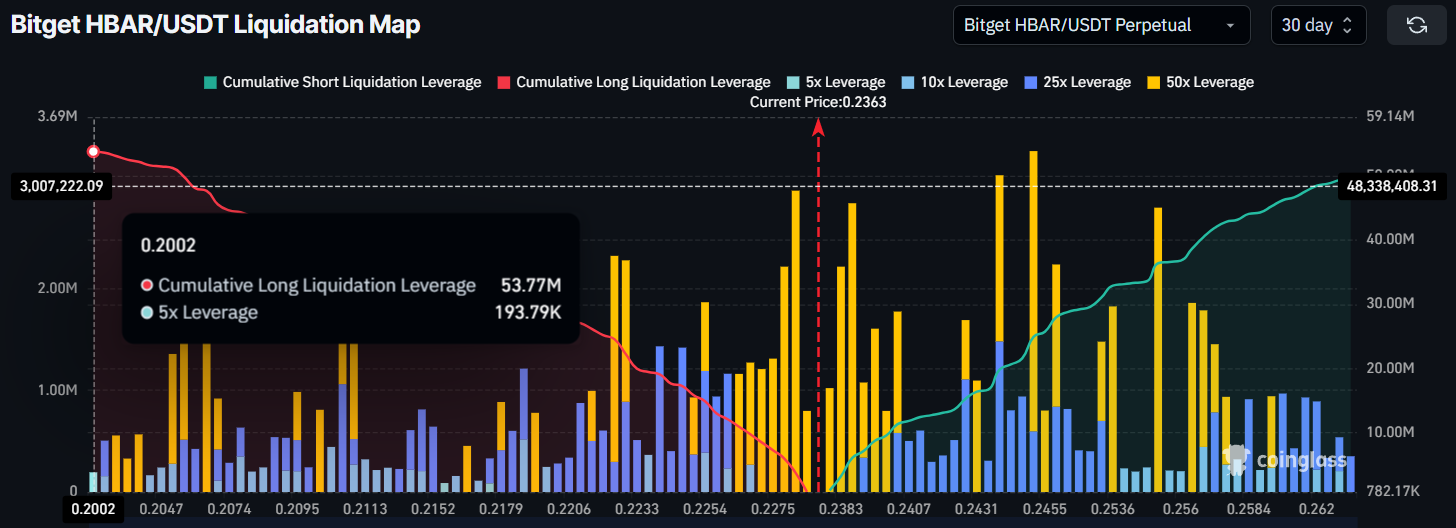

Looking at the liquidation map, there is a real possibility of significant losses for HBAR traders. The map shows that if the price drops to $0.20 or lower, approximately $53 million worth of long positions would be liquidated. This would create a wave of selling pressure and potentially drive the price down further.

Traders who bought into the recent price surge are at risk of losing substantial amounts if the market turns against them. The liquidation risk adds to the bearish sentiment surrounding HBAR, as further price declines could trigger more sell-offs, exacerbating the downturn.

HBAR Price Has A Shot At Preventing Losses

HBAR’s price currently sits at $0.235, and resistance is at $0.241. Despite its recent rally, the broader market conditions are pulling it down, and the next major support level is at $0.220. If the altcoin fails to hold above this level, it could slide towards $0.200.

In the event of a surge in bearish sentiment or increased selling pressure, HBAR could fall below $0.220, hitting the psychological support level at $0.205. A drop below this critical level would likely trigger the $53 million worth of liquidations, further exacerbating the decline.

However, if HBAR manages to hold above $0.220 and successfully breaches the $0.241 resistance, there could be an opportunity for a rally. A successful bounce off $0.220 could push HBAR towards $0.267, providing some relief to traders and reinforcing its bullish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.