A new survey from Deloitte reveals that a growing number of Chief Financial Officers (CFOs) at billion-dollar companies are preparing to integrate cryptocurrency into their business operations. The report notes that nearly one out of four finance leaders expect their organization to adopt digital assets in the coming years.

CFOs Set To Embrace Crypto By 2027

A Deloitte survey report published on July 31 highlights a major shift in corporate finance in North America. According to the new report, 23% of CFOs from billion-dollar firms say their treasury departments plan to adopt cryptocurrencies for payment or investment purposes within the next two years.

The North American CFO Signals survey, conducted in June 2025, polled 200 finance chiefs at companies with revenues exceeding $1 billion. The results suggest that cryptocurrencies are no longer a fringe consideration in enterprise finance but an imminent part of future operations.

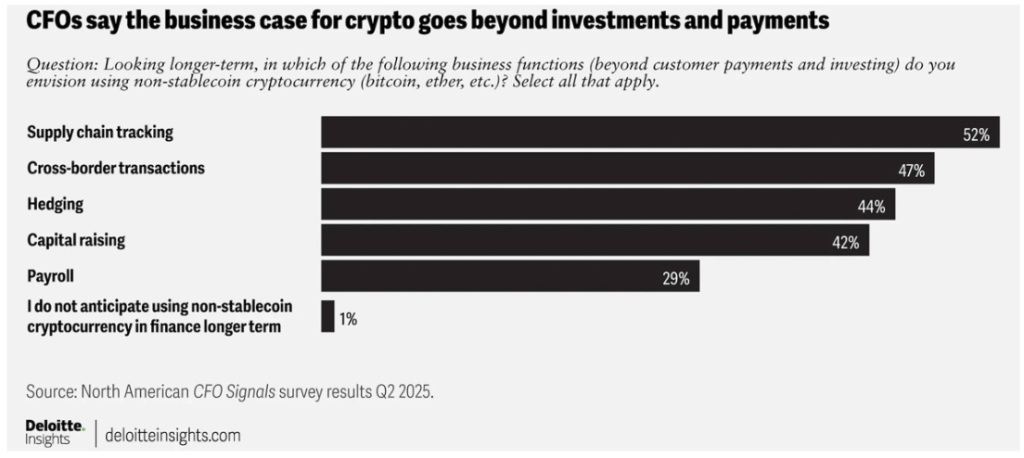

The Deloitte survey showed that only 1% of CFOs ruled out the use of cryptocurrencies in the long term, indicating near universal openness to digital asset adoption at some point. Among firms with more than $10 billion in revenue, the commitment appears to be even stronger, as 40% of their CFOs say crypto could become a component of their finance function by 2027.

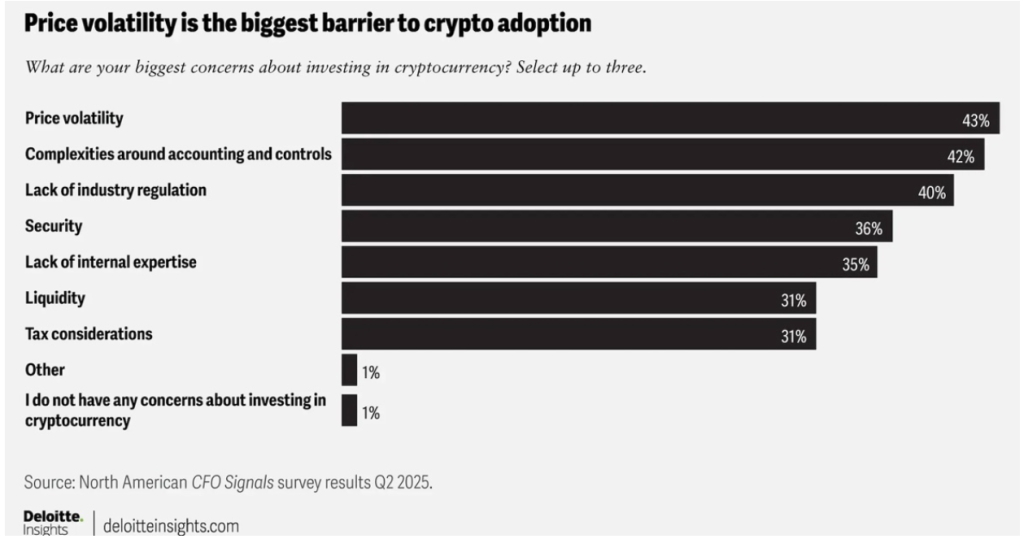

Despite the growing interest in digital currencies, CFOs remain cautious. In the June 4 – 18 survey, 43% of respondents cited price volatility as their top concern. This hesitancy underscores the ongoing uncertainty financial leaders face as they evaluate the risks and potential benefits of integrating crypto into corporate treasury strategies.

Stablecoins, which are backed by reserve assets and pegged to fiat currencies like the US Dollar, are also emerging as a preferred and predictable entry point into digital finance. The survey found that 15% of finance chiefs said their companies may begin using stablecoins for payments within two years, with acceptance rates jumping to 24% for the largest corporations.

Notably, the Deloitte survey links rising interest in crypto adoption to recent US policy moves. A March executive order by President Donald Trump established a Strategic Bitcoin Reserve, and June’s passage of the GENIUS Act has begun to formalize the regulatory landscape. These signals from the US appear to be boosting CFOs’ confidence in cryptocurrencies.

Interest In Non-Stable Crypto Up

Despite broader concerns about regulation and volatility, the Deloitte survey shows a clear uptick in interest among financial executives for non-stable cryptos like Bitcoin and Ethereum. Although 42% of CFOs raised red flags about accounting complexities and 40% cited shifting regulatory landscape, 15% said they plan to invest in non-stable crypto assets within the next 24 months.

This figure jumped to 24%, with nearly 1 in 4 respondents expecting their finance departments to potentially add non-stable cryptocurrencies to their portfolios in the coming years. A key driver behind this growing interest in these digital assets is the potential for significant capital appreciation. Bitcoin, for example, has surged remarkably by approximately 90% in the past year despite experiencing major price swings.

Featured image from Pexels, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.