Cathie Wood is sounding the alarm on gold just as global markets experience one of the most violent cross-asset swings in recent years.

As equities, precious metals, and futures markets whipsawed within hours, the ARK Invest founder argued that gold’s latest surge bears the hallmarks of a late-cycle bubble—one now colliding with leverage, crowded positioning, and fragile market structure.

Sponsored

Sponsored

Cathie Wood Warns of Gold Bubble as $9 Trillion Market Shakeout Hits

According to Cathie Wood, the odds are high that the gold price is heading for a fall, with the Ark Invest executive pointing to an extreme valuation signal rarely seen in modern financial history.

According to her analysis, gold’s market capitalization as a share of the US money supply (M2) hit an all-time high intraday, surpassing both the 1980 inflation peak and levels last seen during the Great Depression in 1934.

“In our view, the bubble today is not in AI, but in gold,” Wood said, arguing that current prices imply a macro crisis that does not resemble either the inflationary 1970s or the deflationary collapse of the 1930s.

She noted that while foreign central banks have been diversifying away from the dollar, US bond markets tell a different story, with the 10-year Treasury yield retreating from its 2023 peak near 5% to around 4.2%.

An eventual upturn in the dollar, she warned, could puncture gold’s rally much as it did between 1980 and 2000, when gold prices fell more than 60%.

However, not everyone agrees with Wood’s framework. Macro traders pushed back, arguing that gold-to-M2 is no longer a reliable signal in a post-QE, post-digital financial system.

Sponsored

Sponsored

In that view, the chart may say less about gold being in a bubble and more about traditional monetary aggregates losing informational value.

$9 Trillion Volatility Shock Shows How Leverage and Crowded Trades Fueled a Market Flush

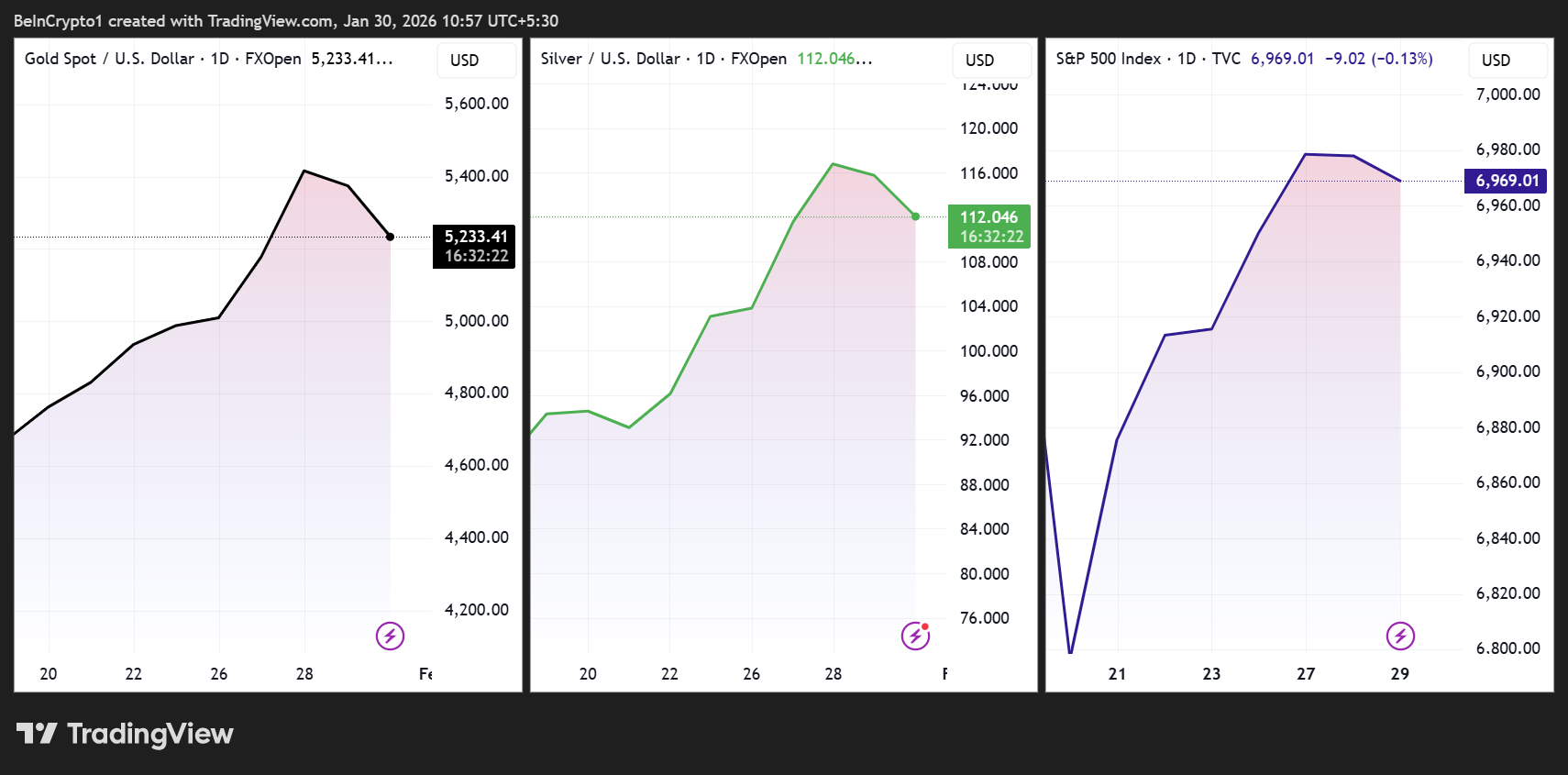

It follows a backdrop of a dramatic market stress test. During a single trading session, gold fell roughly 8%, wiping out nearly $3 trillion in market capitalization. Silver dropped by more than 12%, erasing about $750 billion in value.

US equities were hit in parallel, with the S&P 500 and Nasdaq shedding more than $1 trillion intraday before rebounding sharply by the close.

Sponsored

Sponsored

By the end of the session, much of the damage had been retraced. Gold recovered close to $2 trillion in market value, silver regained roughly $500 billion, and US equities clawed back more than $1 trillion.

In total, analysts estimated that around $9 trillion in market capitalization swung across metals and equities within roughly six and a half hours, an illustration of extreme volatility rather than a permanent destruction of value.

Analysts such as The Bull Theory agree that leverage, not fundamentals, was the primary catalyst. Futures traders had piled into gold and silver with aggressive leverage, in some cases as high as 50x to 100x. This followed multi-year rallies that saw gold rise around 160% and silver nearly 380%.

When prices began to slip, forced liquidations and margin calls accelerated the move. In silver, the pressure intensified after CME raised futures margins by up to 47%, forcing additional selling into thin liquidity.

Sponsored

Sponsored

Equities provided the initial spark. Microsoft, a heavyweight in major indices and systematic risk models, fell as much as 11–12% after softer cloud guidance, rising AI-related capital expenditures, and its removal from Morgan Stanley’s list of top picks.

The selloff mechanically dragged the Nasdaq and S&P 500 lower, triggering index-linked selling, volatility-targeting reductions, and cross-asset de-risking. As correlations tightened, metals, already stretched and crowded, broke alongside stocks.

Macro analysts emphasized that the episode was not driven by a Fed surprise, geopolitical escalation, or sudden shift in economic policy.

Instead, it reflected a balance-sheet reset. When growth slows at the margin, capital spending surges, and leverage stacks on top of crowded trades, price discovery does not happen smoothly. It gaps.

Taking all these together, the incident mirrors how quickly leverage can turn a popular trade into a violent unwind.