Bitcoin is currently consolidating below the $125,000 level after a sharp correction that pushed the price down to $120,000, a key psychological and technical area of support. Despite the recent volatility, bulls are showing resilience, holding price levels that suggest the broader uptrend remains intact. However, uncertainty persists as some analysts warn that a deeper correction toward lower demand zones could still occur before the next leg higher.

Interestingly, onchain data provides a more optimistic signal. Metrics indicate that Bitcoin miners are not in a hurry to sell, suggesting strong conviction in the market’s long-term trajectory. This stability from miners — historically one of the largest sources of selling pressure — reflects growing confidence in the sustainability of current price levels.

As the market navigates this phase of consolidation, traders are watching whether Bitcoin can reclaim $125K and establish a new base for continuation. For now, the combination of miner confidence and stable demand suggests the market is preparing for its next decisive move rather than signaling exhaustion.

Bitcoin Miners Remain Strong

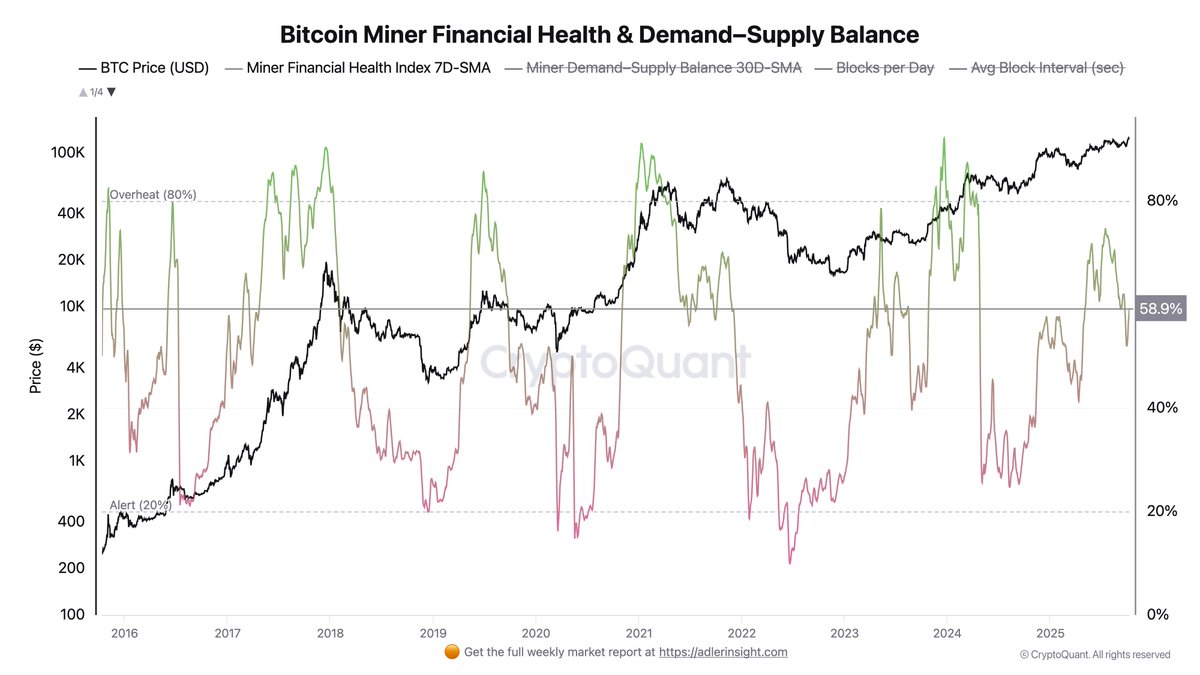

Top onchain analyst Axel Adler shared new insights into the state of the Bitcoin mining economy through the Miner Financial Health Index — a composite metric designed to measure the financial condition of miners by accounting for hashprice, block profit, fee share, and overall cash flow. According to Adler, the index currently stands at 59%, which represents a healthy, neutral-to-bullish mining economy.

This reading indicates that miners are operating in a stable environment with balanced profitability and no signs of distress. Importantly, the absence of excessive stress or euphoria suggests that miners are not under pressure to liquidate holdings, a factor that often contributes to market stability. Historically, periods when the index stays within the 50–65% range have coincided with steady price growth, as miners tend to accumulate or hold their rewards rather than selling into rallies.

Adler notes that a sharp rise above 80% would mark the beginning of a distribution phase, typically associated with increased miner selling as profits peak. For now, the moderate reading highlights that the current cycle still has room for growth before reaching overheated levels.

This insight aligns with other onchain indicators showing robust network activity and strong miner confidence, reinforcing the notion that Bitcoin’s recent correction remains a healthy consolidation phase rather than a sign of structural weakness. As long as miners continue to operate profitably and refrain from large-scale selling, Bitcoin’s underlying market foundation remains firm — setting the stage for potential renewed momentum once price volatility subsides.

Bitcoin Price Analysis: Bulls Defend $120K Support

Bitcoin (BTC) is trading around $121,400, consolidating after a brief pullback from the $126,000 all-time high. The daily chart shows BTC holding above key support levels, with the 50-day (blue) and 100-day (green) moving averages trending upward — confirming that the broader structure remains bullish.

The $120,000–$121,000 zone is emerging as a short-term support area, where buyers have stepped in to defend against further downside. A sustained move above $123,500 could open the door for a retest of $125,000, while a breakdown below $120,000 would likely expose BTC to a deeper correction toward the $117,500 level, a major horizontal support that previously acted as resistance in September.

Momentum indicators suggest the market is in a cooling phase after an extended rally, allowing for potential re-accumulation before the next major move. The recent consolidation aligns with on-chain data showing miners maintaining confidence and no significant selling pressure.

Bitcoin remains structurally bullish, as long as price holds above $117,500. Traders will watch for a breakout above $125,000 to confirm renewed momentum and potentially push BTC into price discovery territory once again.

Featured image from ChatGPT, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.