Standard Chartered has become the first big bank to launch spot trading for Bitcoin and Ethereum, a major milestone for cryptocurrency adoption.

Standard Chartered Launches Bitcoin, Ethereum Trading For Institutions

According to a press release, Standard Chartered has just rolled out deliverable spot trading for the two largest names in the cryptocurrency sector, Bitcoin and Ethereum. “In line with its commitment to offer clients safe, trusted and efficient digital assets solutions and following the successful launch of its digital assets custody service, Standard Chartered has today launched a fully integrated digital assets trading service for institutional clients,” reads the press release.

Standard Chartered is a global systemically important bank (G-SIB) headquartered in the United Kingdom (UK). The bank has branches around the world, but the digital asset trading launch is specifically coming through the UK arm.

This is the first example of a G-SIB offering deliverable spot trading services related to cryptocurrencies. G-SIBs are powerful institutions considered so integral to the global economy that their breakdown could trigger a wider financial crisis. As such, regulators closely watch these banks and put them through tighter scrutiny than normal institutions. Thus, for a G-SIB to enter the Bitcoin spot trading space could signal the progress digital assets have made in being accepted by traditional finance.

“Digital assets are a foundational element of the evolution in financial services,” said Bill Winters, Group Chief Executive of Standard Chartered. “They’re integral to enabling new pathways for innovation, greater inclusion and growth across the industry.”

While this is the first time the bank is offering Bitcoin and Ethereum spot trading services to institutions, it’s not its first venture into the wider digital asset space. Standard Chartered has investments in Zodia Custody and Zodia Markets, firms offering a range of cryptocurrency-related services.

“We are applying our global expertise, infrastructure and risk management frameworks that our clients trust to the digital assets space,” said Tony Hall, Global Head of Trading and XVA, Markets, at Standard Chartered.

The G-SIB’s latest service plugs into the bank’s existing infrastructure, allowing institutional clients to take part in Bitcoin and Ethereum trading activities through Foreign Exchange (FX) interfaces that they already use. “Clients can settle to their choice of custodian, including Standard Chartered’s secure digital assets custody solutions,” added the press release.

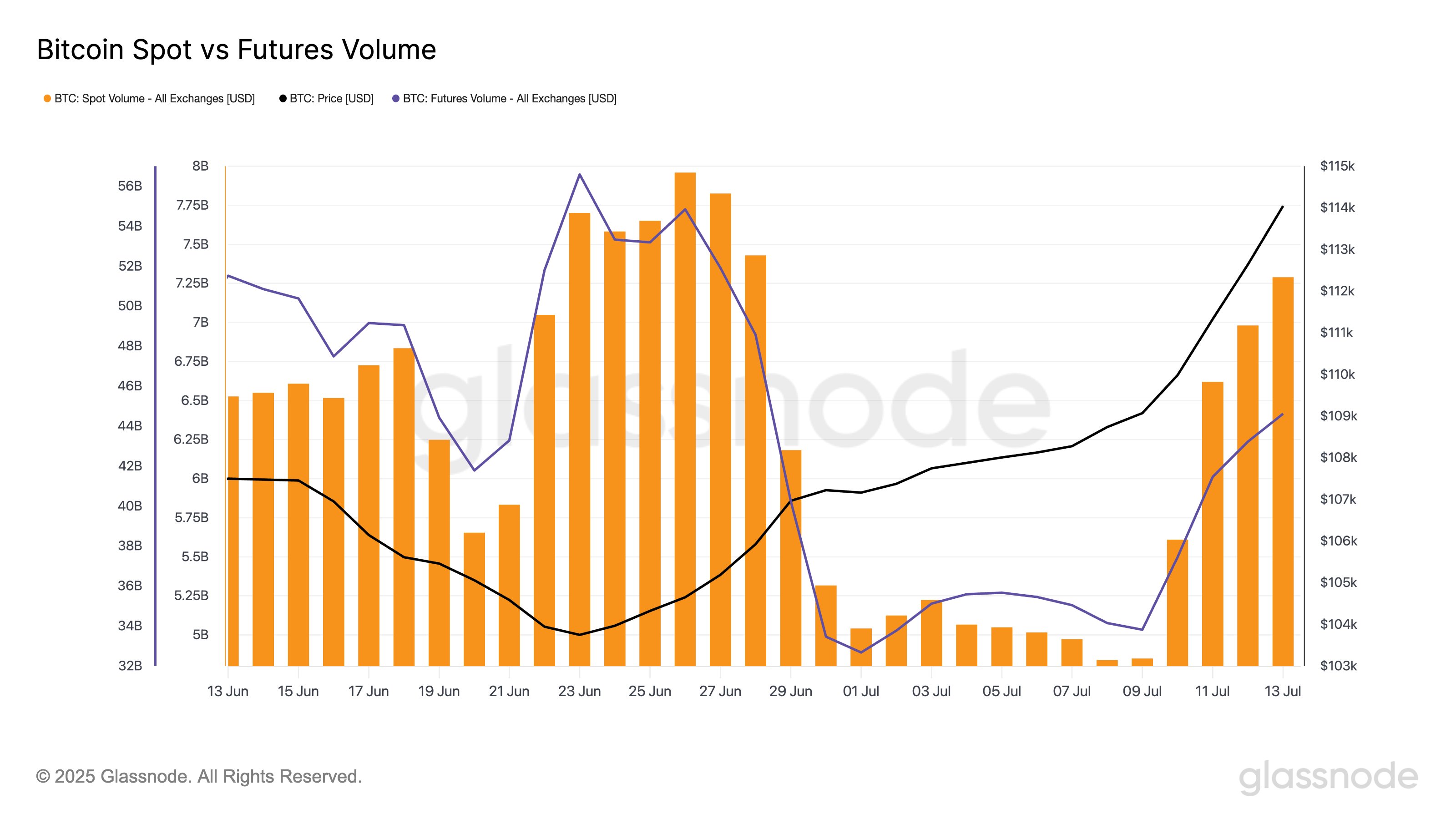

In some other news, Bitcoin spot trading volume has seen a revival alongside the latest price surge, as the on-chain analytics firm Glassnode has pointed out in an X post.

The trend in the spot and futures trading volumes related to BTC | Source: Glassnode on X

Since July 9th, spot volume has increased by 50.3% and futures volume by 31.9%. While this is clearly a significant jump, the wider picture remains that of trading activity being relatively muted. Compared to the year-to-date average, spot and futures volumes are both down more than 20%.

BTC Price

At the time of writing, Bitcoin is trading around $117,000, up over 7.5% in the last week.

The price of the coin has seen a drop over the past day | Source: BTCUSDT on TradingView

Featured image from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.