The overall cryptocurrency market made a strong recovery in Q2 2025, driven primarily by Bitcoin’s (BTC) historic price surge and robust inflows into exchange-traded funds (ETFs). However, despite healthy digital asset performance, average daily trading volume in the market declined.

Bitcoin Record Highs Fail To Boost Daily Trading Volume

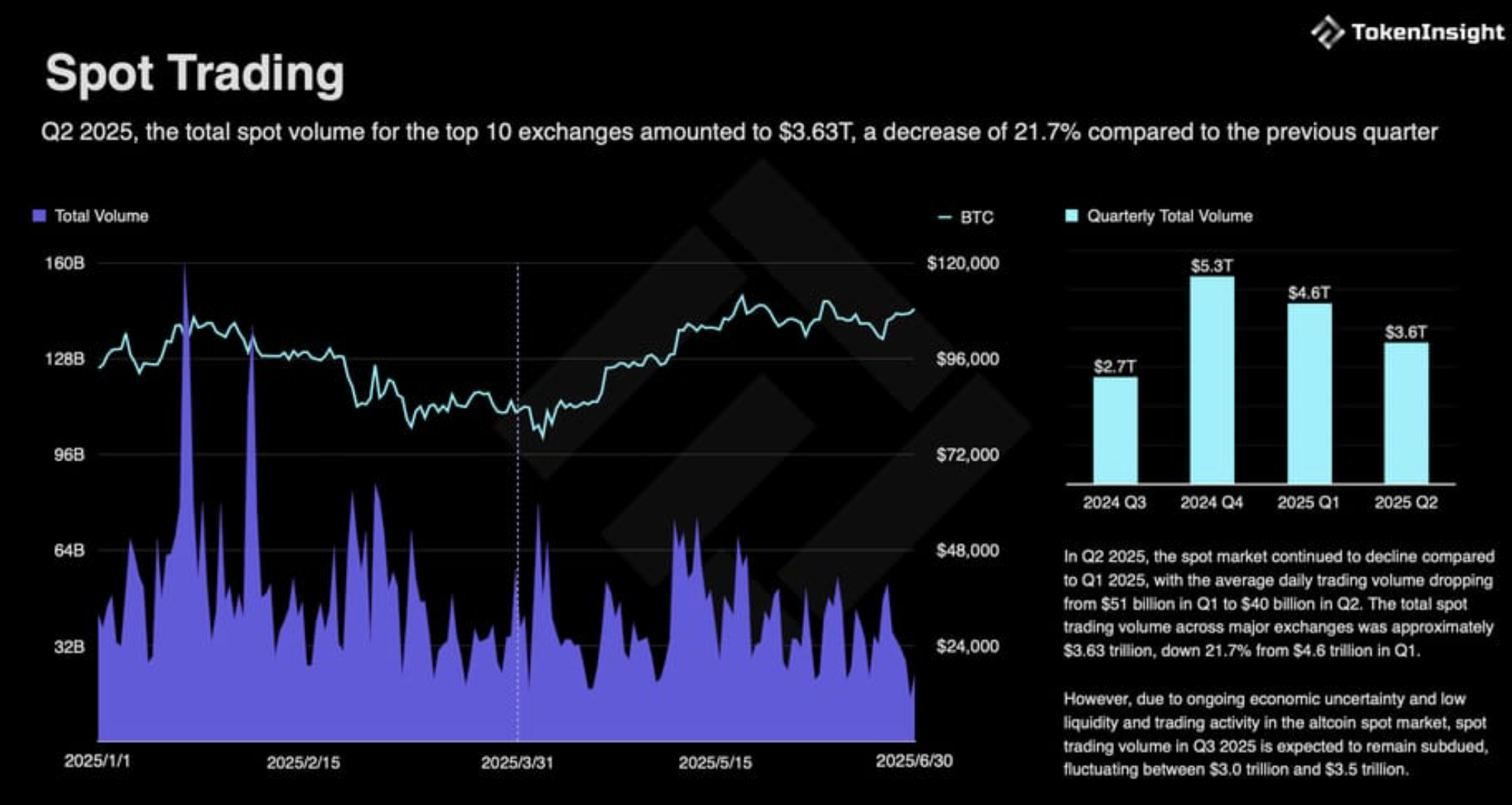

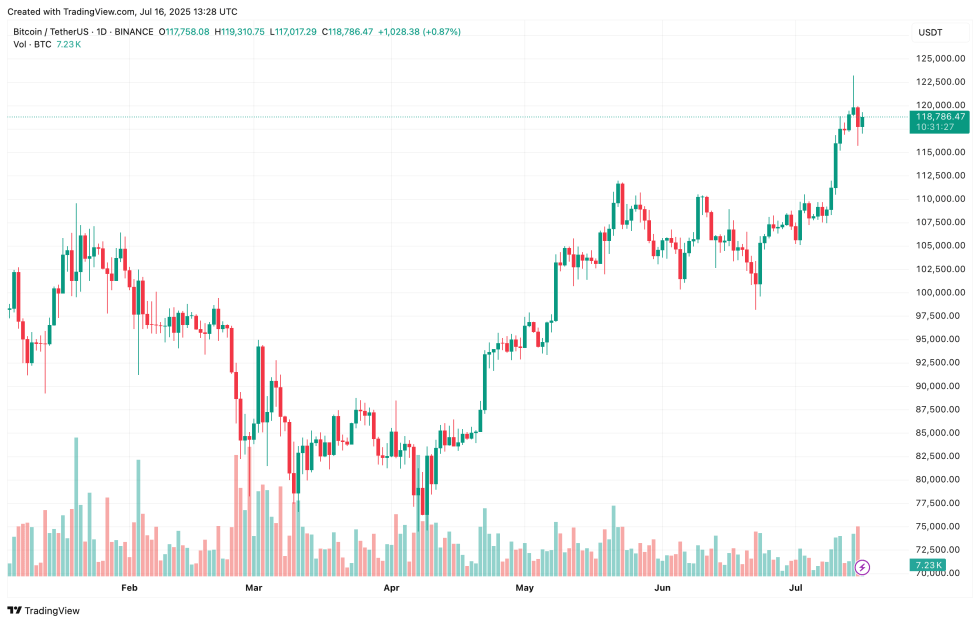

According to a report published today by TokenInsight, the crypto spot market trading volume experienced a decline in Q2 2025 compared to Q1 2025 – despite Bitcoin rising from a low of $83,000 to a high of $111,900, and closing the quarter near $106,000.

The report notes that average daily trading volume fell from $51 billion in Q1 2025 to around $40 billion in Q2 2025, representing a drop of approximately 10%. Meanwhile, total spot trading volume across all exchanges slumped from $4.6 trillion to $3.6 trillion over the same period.

Looking ahead, spot trading volume in Q3 2025 is expected to remain subdued, due to ongoing macroeconomic uncertainty, weak liquidity, and sluggish trading activity in the altcoin market. TokenInsight predicts total spot volume in Q3 to range between $3 trillion and $3.5 trillion.

Interestingly, the spot market’s share of total trading volume declined across most exchanges. Only MEXC and Bitget bucked the trend, increasing their spot trading shares by 2.70% and 0.66%, respectively.

As traders continue to hedge risks and capitalize on volatility, high-frequency derivatives trading remained the preferred strategy, consistent with Q1 2025 trends. The report noted:

This trend also underscored a sharper downturn in the spot market, as liquidity and trading activity in many altcoins dropped significantly, in contrast to the relative resilience of derivatives markets.

That said, derivatives volume also pulled back slightly, falling 3.6%, from $20.9 trillion in Q1 2025 to $20.2 trillion in Q2 2025. While the US Federal Reserve’s temporary rate pause lifted markets in April, rising geopolitical tensions dampened investor appetite for risk-on assets.

Binance Reigns Supreme Amid Tumultuous Quarter

In Q2 2025, Binance remained the dominant exchange, capturing 35.39% of total trading volume – the only platform to hold more than one-third of the market. However, this marked a slight drop from 36.57% in Q1 2025.

Meanwhile, five exchanges – OKX, Bitget, HTX, Gate, and KuCoin – saw gains in market share. Gate led the pack with a 2.55% increase, followed by OKX with a 1.08% rise.

Despite the muted Q2 trading volumes, liquidity is expected to continue flowing into the digital asset space, fueled by the ongoing rise in stablecoin market capitalization. At press time, Bitcoin trades at $118,786, up 0.9% in the past 24 hours.

Featured image from Unsplash.com, charts from TokenInsight and TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.