Bitcoin (BTC) is attempting to reclaim the $110,000 level after a sharp downside move pressured markets and triggered renewed volatility across the crypto landscape. While this pullback has been uncomfortable for short-term traders, it remains modest compared to the October 10 liquidation crash, which forced out excessive leverage and marked one of the most aggressive sell-offs of the year.

Despite the short-term turbulence, Bitcoin remains within its broader consolidation range — but the market now enters a critical phase where direction must soon resolve. Over the coming weeks, macro developments, liquidity flows, and investor positioning will likely determine whether the next impulse is upward or downward.

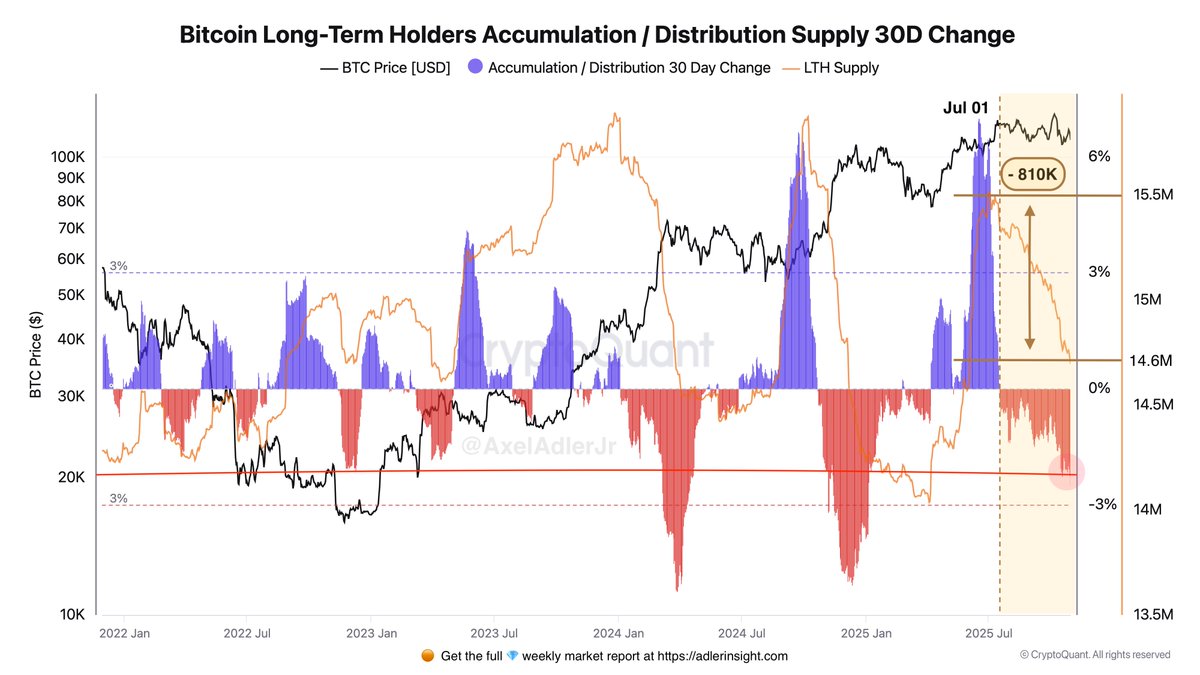

Fresh CryptoQuant data shows that since July 1, long-term holders (LTHs) have been steadily distributing coins, selling into strength as BTC approached and later tested all-time highs. This supply overhang has contributed to muted upside momentum, even as demand has proven strong enough to absorb much of the selling.

Bitcoin Market Still Absorbs Supply

According to analyst Axel Adler, Bitcoin continues to navigate a complex supply-demand environment defined by steady profit-taking from long-term holders (LTHs). Since July 1, LTHs have distributed roughly 810,000 BTC, reducing their total holdings from 15.5 million to 14.6 million BTC.

This represents one of the most significant distribution phases in the current cycle — a clear indication that seasoned holders have been locking in profits after years of accumulation and strategic positioning.

What makes this dynamic particularly striking is that Bitcoin has printed new all-time highs twice during this distribution phase, demonstrating that market demand has remained robust enough to absorb the substantial supply being offloaded.

Historically, similar phases of distribution from long-term holders often accompany major cycle inflection points, as capital shifts from early investors to new participants entering the market.

Adler emphasizes that while this absorption reflects market strength, it also sets a ceiling on aggressive upside momentum. As long as long-term holders continue to realize profits, the path higher is likely to remain gradual and choppy rather than explosively parabolic. Strong demand is supporting prices and preventing deeper corrections — but supply pressure is simultaneously preventing sustained breakout acceleration.

The takeaway is clear: Bitcoin is not lacking demand; it is working through supply once long-term distribution slows — whether due to exhaustion or macro reinforcement — upside potential could expand meaningfully. Until then, price action may continue to grind sideways with upside attempts meeting resistance as supply transitions to new owners.

Bitcoin Holds Above Key MA

Bitcoin (BTC) is trading around $109,900, attempting to stabilize after a recent downside move pushed price back toward the 200-day moving average (red line) — a key long-term support level that currently sits near $108,000.

This region has become an important defense line for bulls, structuring the lower boundary of Bitcoin’s consolidation range. Each time BTC has approached this zone over the past month, buyers have stepped in, signaling continued demand despite short-term weakness.

However, reclaiming momentum remains a challenge. BTC continues to struggle below the 50-day (blue) and 100-day (green) moving averages, which have converged overhead and now act as layered resistance between $112,000 and $114,000.

A sustained break above this cluster is required to re-establish bullish momentum and set up another attempt toward the $117,500 resistance — the cycle’s key Point of Control and the level that has repeatedly capped upside moves since summer.

If Bitcoin loses the $108,000 support, a deeper correction toward $105,000–$103,000 becomes likely, where liquidity and previous reaction levels sit. For now, the technical picture remains neutral-to-cautious: bulls are holding essential support, but the burden remains on buyers to reclaim lost moving averages and flip market structure back in their favor.

Featured image from ChatGPT, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.