In brief

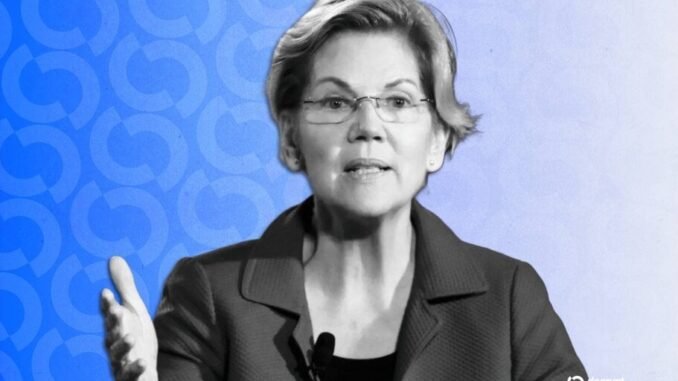

U.S. Senator Elizabeth Warren has asked the Treasury and Fed to confirm that they would not engage in “propping up” crypto firms or investors.

Bitcoin has fallen roughly 50% from its October high.

The Treasury secretary said the government lacks authority to support Bitcoin with public funds.

U.S. Senator Elizabeth Warren (D-MA) has urged the Treasury Department and the Federal Reserve to confirm they will not use taxpayer dollars to prop up Bitcoin or rescue cryptocurrency firms as prices continue to slide.

“Your agencies must refrain from propping up Bitcoin and transferring wealth from taxpayers to crypto billionaires through direct purchases, guarantees, or liquidity facilities,” the Massachusetts Democrat wrote Wednesday in a letter to Treasury Secretary Scott Bessent and Federal Reserve Chair Jerome Powell, according to CNBC.

Warren’s letter comes amid heightened scrutiny of the crypto industry and the federal government’s role in digital asset markets. Both the Treasury Department and the Fed have authorities that allow them to provide financial support to banks and other entities during periods of market stress, powers that were used extensively during past financial crises. Warren said it remains “deeply unclear what, if any, plans the U.S. government currently has to intervene in the current Bitcoin selloff.”

Bitcoin has dropped about 50% since reaching a high in October, a slide that Warren said has been amplified by cascading liquidations of leveraged positions. The downturn has rattled major investors and companies with significant Bitcoin exposure.

The cryptocurrency is currently trading at just under $67,000, down 0.4% on the day according to CoinGecko data. On prediction market Myriad, owned by Decrypt’s parent company Dastan, users place a 64% chance on its next move taking it further downward, to $55,000.

Digital assets in the U.S.

The debate over a potential bailout comes as policymakers weigh a broader embrace of digital assets in the United States. Since Trump’s return to power, some states have explored establishing strategic Bitcoin reserves, lawmakers have proposed allowing Bitcoin in certain public pension portfolios, and federal agencies have advanced pro-digital asset initiatives aimed at integrating crypto more fully into the financial system.

In her letter, Warren argued that government intervention would disproportionately benefit wealthy investors and industry insiders. She warned that a bailout “would be deeply unpopular to transfer wealth from American taxpayers to cryptocurrency billionaires” and said it could also enrich President Donald Trump and his family through their links to DeFi venture World Liberty Financial.

Warren pointed to recent transactions by World Liberty Financial, which she said sold roughly 173 wrapped Bitcoin to repay $11.75 million in USDC stablecoin debt and avoid liquidation as prices fell below $63,000. She also cited reported losses among prominent crypto investors and executives as evidence of the risks embedded in the market.

Warren’s crypto skepticism

This isn’t the only comment that Warren, a long time crypto critic, has made about the industry this month. On February 9 she said the recent volatility underscores her broader concerns about the industry. “No one should celebrate when Americans lose their hard-earned money,” she said in a statement.

“The crypto falloff underscores why we need to make sure there are ordinary, commonsense consumer protections in place for this industry,” she added. “Without cops on the beat, there’s too much risk that crypto billionaires, including Donald Trump and the Trump family, and other insiders take care of themselves and shove all the losses off on small traders or retirees.”

At a House Financial Services Committee hearing on February 4, Bessent pushed back against speculation about a federal strategic Bitcoin reserve, saying the government has no legal authority to support or “bail out” Bitcoin using public funds.

Asked whether taxpayer money could be deployed into crypto assets, Bessent said the Treasury is “retaining seized Bitcoin” but indicated there is no mechanism to direct banks to purchase Bitcoin or to use public funds to stabilize the market.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.