Movements in USDT, the market’s largest stablecoin by capitalization, are showing rare signals after many years. Market cap growth has shifted from slowing to negative. This change raises concerns that a bear market may be just beginning.

As a proxy for investors’ willingness to buy, changes in USDT’s market cap can help assess current conditions. They can also suggest possible future scenarios.

Sponsored

Sponsored

Market Recovery Struggles as Tether’s Market Cap Shows Reversal Signs

CryptoQuant’s 60-day average USDT Market Cap Change data turned negative in February. The last time this occurred was in Q3 2023.

The chart shows the correlation between Bitcoin’s price and the USDT market cap growth. When USDT expands, new liquidity enters the crypto market. When growth turns negative, capital leaves the market instead of waiting on the sidelines.

Analyst Crypto Tice argues that the consequences are clear. Buying power weakens. Downside support becomes fragile. Rallies are sold off more quickly.

“Historically, sustained upside in $BTC doesn’t happen when stablecoin supply is contracting,” Tice said.

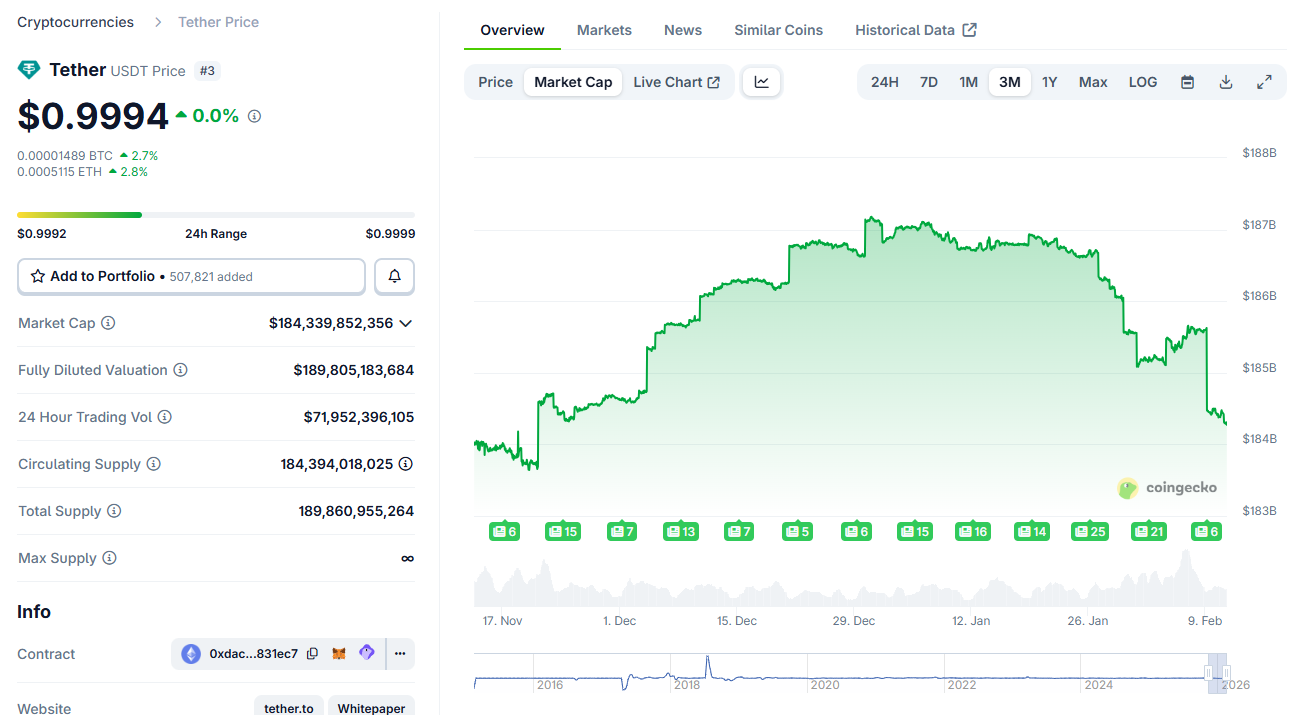

Negative market cap growth may stem from slowing demand for newly issued USDT. CoinGecko data shows that since early January, USDT’s market cap has declined from over $187 billion to $184.3 billion.

Sponsored

Sponsored

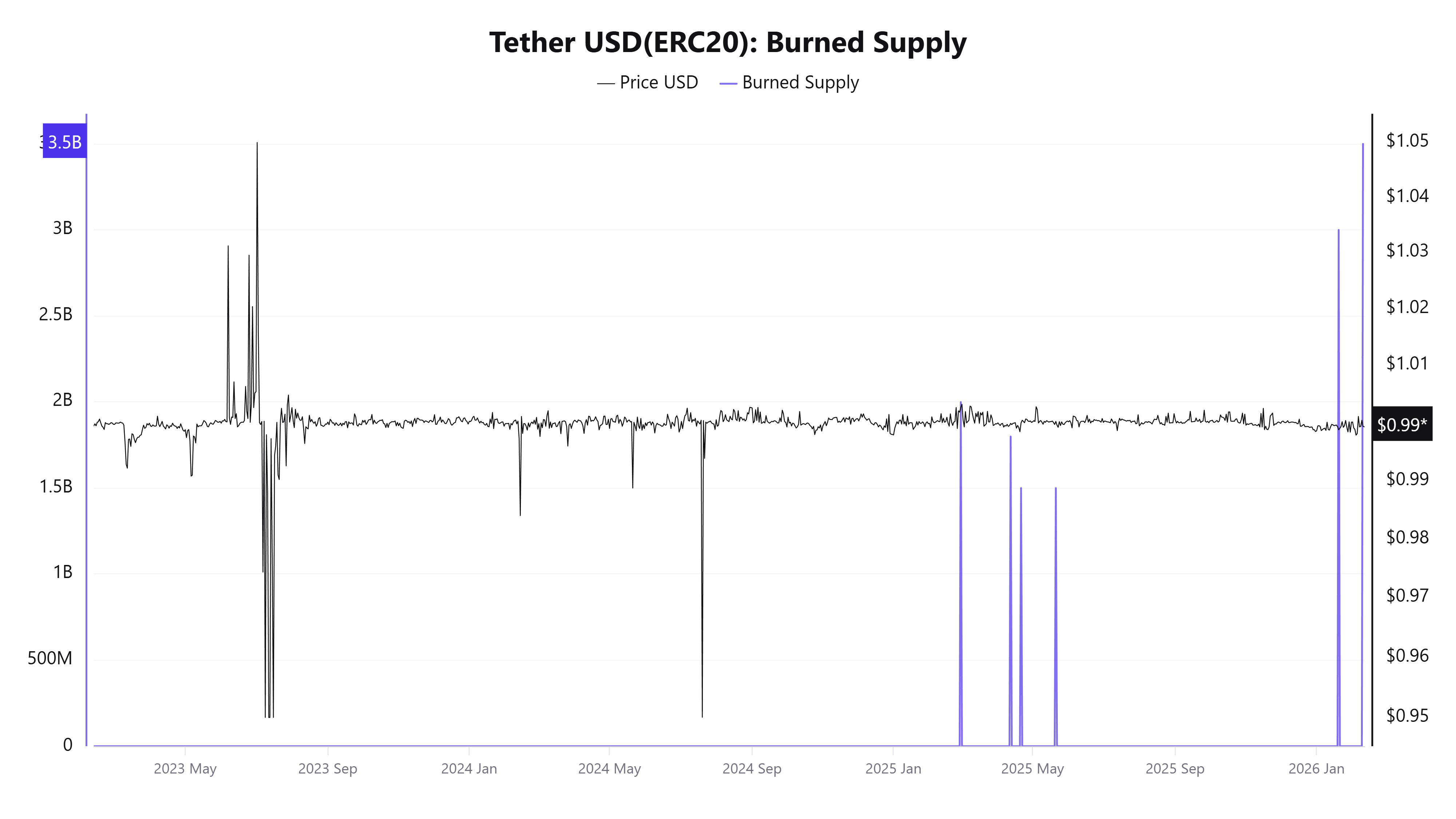

This decline may result from Tether’s recent USDT burn activity. On February 10, Whale Alert reported that Tether burned 3.5 billion USDT. The company also burned 3 billion USDT last month.

Statistics from CryptoQuant show that these are the two largest consecutive burns in history.

These burns reflect investors converting USDT back into fiat. Tether removes redeemed USDT from circulation to ensure the supply matches its reserves and maintains the 1:1 peg.

“USDT supply is now in a downtrend for the first time since Q1 2025. Not a good sign,” investor Ted said.

However, historical data offers context. Since 2022, periods when the 60-day average Market Cap Change turned negative typically lasted around two months. These phases often coincided with Bitcoin moving sideways and forming a local bottom.

Examples include November 2022 to January 2023 and August to October 2023. As a result, the current data may point to a stagnant low-level market or a deeper decline over the next two months before a recovery.

BeInCrypto’s latest analysis outlines a bearish scenario. Bitcoin could fall below $43,000 if the key $63,000 support level breaks.