The Zcash price is approaching a critical moment. Technical structure is weakening, momentum is stalling, and derivatives positioning shows a clear bearish lean. Around $15 million is positioned for downside on Zcash perpetuals, signaling growing conviction that a breakdown is coming.

At the same time, only one group is quietly pushing back. Mega whales are adding while most others step aside. The question now is whether this turns into a full breakdown or a rare reversal against positioning.

Sponsored

Sponsored

Technical Risks and $15 Million in Bearish Positioning Align

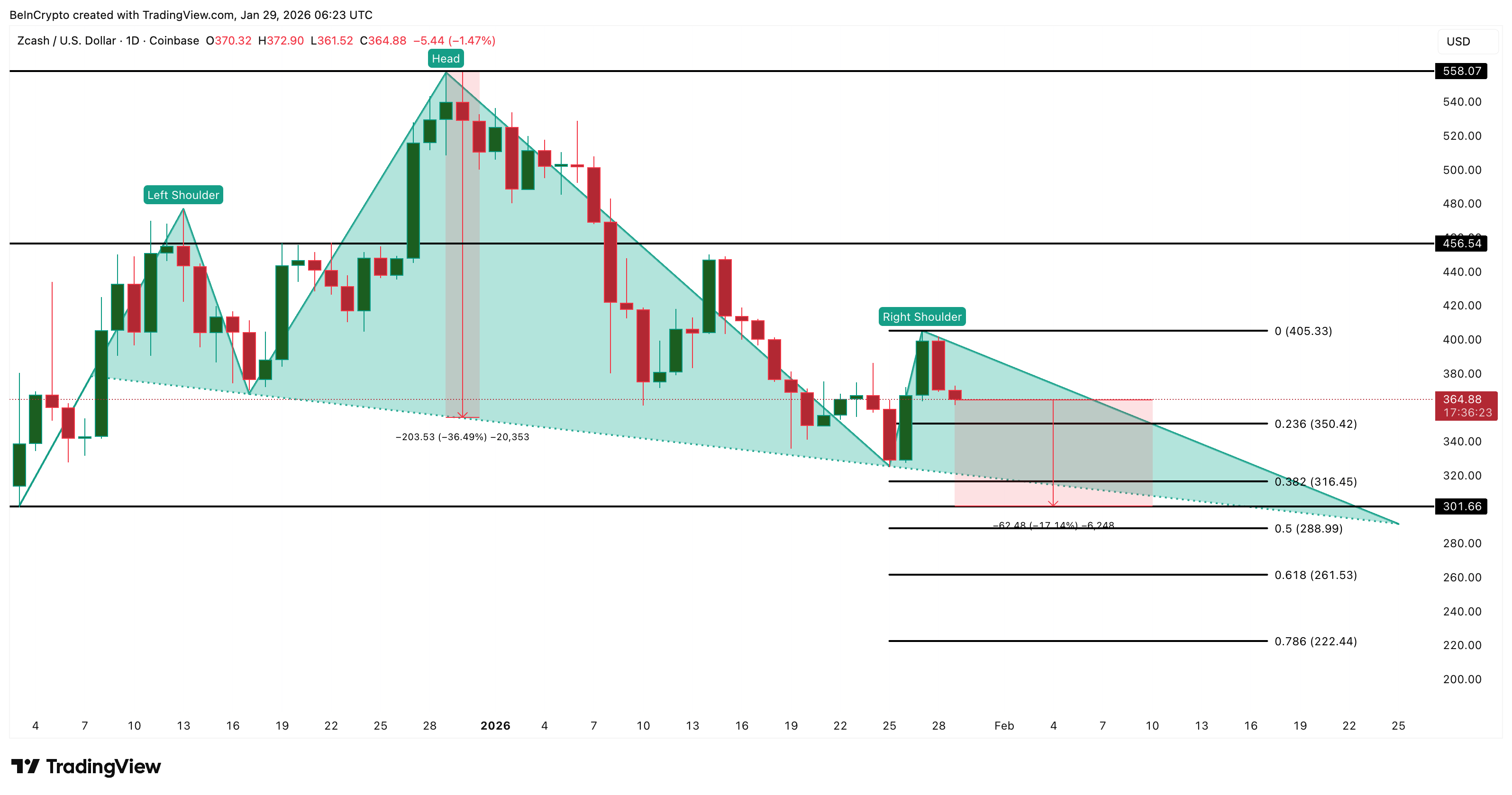

The Zcash price chart is flashing a growing risk.

A head-and-shoulders pattern is forming on the daily chart, with the neckline converging near the $301 zone. This structure typically signals trend exhaustion, especially when price fails to regain prior highs. Zcash is currently trading below the right shoulder, keeping the 36% breakdown pattern active.

Momentum confirms the risk.

Between January 14 and January 27, the Zcash price formed a lower high, but the Relative Strength Index (RSI) stalled near the 49 level instead of pushing higher. RSI measures momentum. When the price weakens while the RSI fails to improve, it shows buyers are losing strength. This is not consolidation. It signals fading demand, which often appears before breakdowns rather than recoveries.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

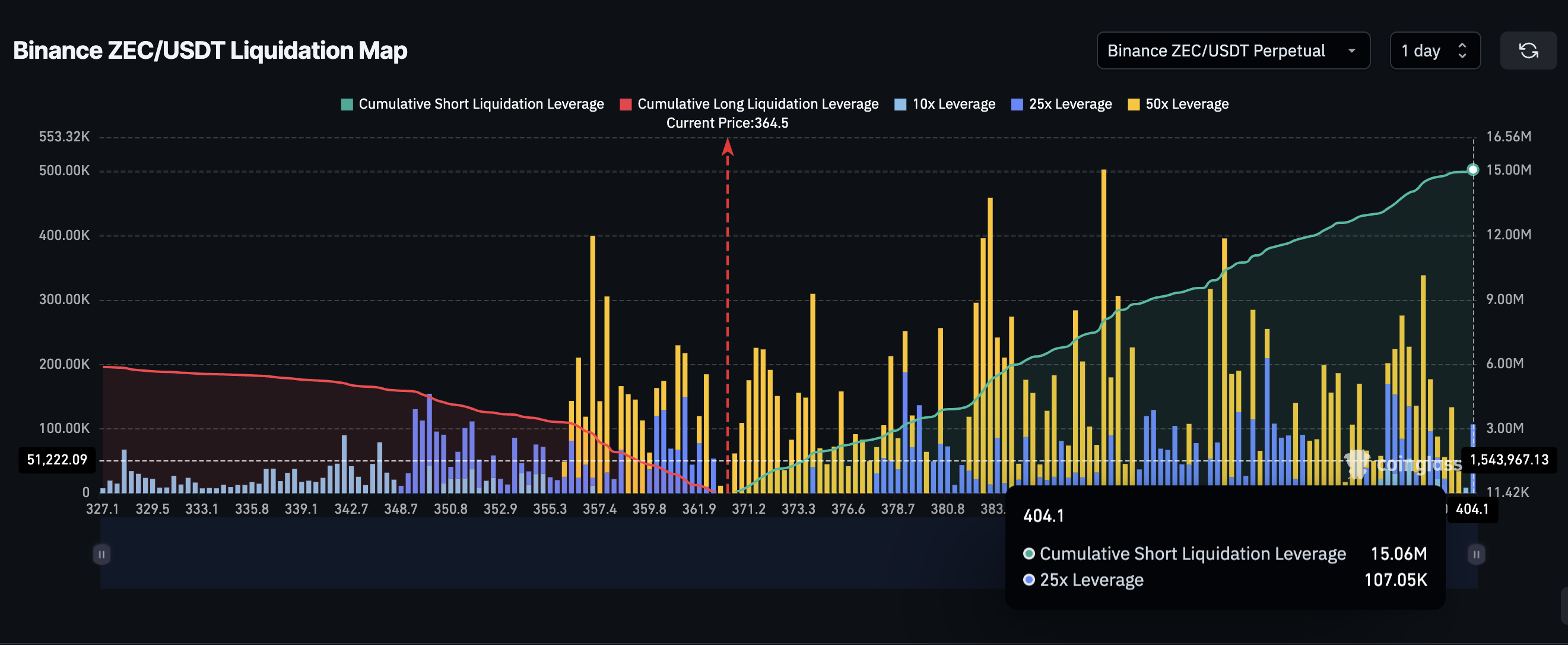

Derivatives positioning reinforces that view.

On Binance’s ZEC perpetual pair, over $15 million sits in short liquidation leverage, while long liquidation leverage is closer to $6 million. Shorts outweigh longs by more than 2.5x, indicating traders are positioned for downside continuation rather than neutral volatility. This kind of imbalance usually appears when markets expect support to fail rather than hold.

Sponsored

Sponsored

Together, structure, momentum, and positioning all point toward rising breakdown risk.

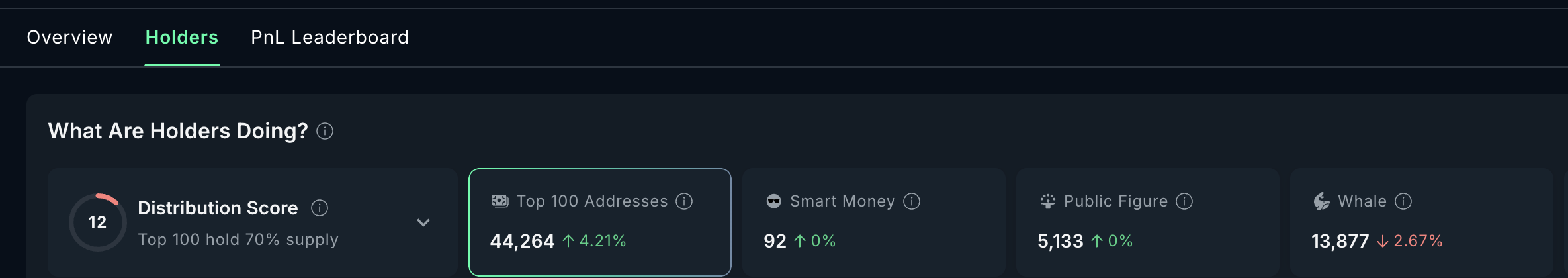

Mega Whales Add Quietly While Others Step Back

Spot behavior tells a very different story.

Top 100 Zcash addresses increased holdings by 4.21% over the past 24 hours, lifting their combined balance to 44,264 ZEC. This is not aggressive accumulation, but it is notable given the broader lack of interest elsewhere.

Sponsored

Sponsored

The contrast matters. Smart money wallets are flat. Standard whale wallets reduced exposure. Public figure wallets show little activity. Only mega whales are adding, and they are doing so cautiously rather than chasing price.

Spot market activity has also fallen sharply. Net outflows, which peaked near $15.60 million, have dropped to around $2.04 million, marking an 87% decline in spot buying pressure.

This split suggests intent.

Mega whales appear to be positioning early around support, betting that the neckline holds or that downside becomes overextended. Everyone else remains defensive.

Sponsored

Sponsored

If the Zcash price breaks down, mega whales are early and exposed. If support holds, they benefit from positioning against consensus.

Zcash Price Levels That Decide Breakdown or Survival

On the downside, losing $350 increases pressure toward $316. A daily close below $301 would break the neckline and activate the full head-and-shoulders structure. Below that, downside risk opens toward $288, with deeper weakness possible if selling accelerates.

On the upside, the bearish case weakens if Zcash reclaims $405, something mega whales could be betting on. A move above $456 would further stabilize the structure.

The full bearish setup only disappears if price reclaims $558, the head of the bearish pattern, which currently sits well above market levels.